Consumer Digest: November 2022

Welcome to the November of the Consumer Digest, where we aim to provide relevant, informative and actionable insights around consumer trends. This month, we’re looking at growing inflation and financial concern ahead of the holiday season and how consumers are responding. We’ll also look at how consumers are planning to get into the holiday spirit this year.

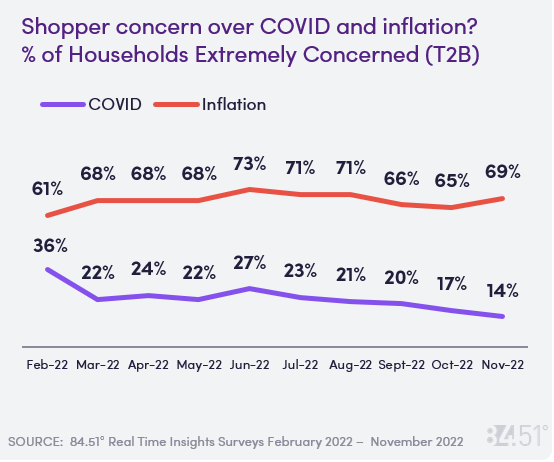

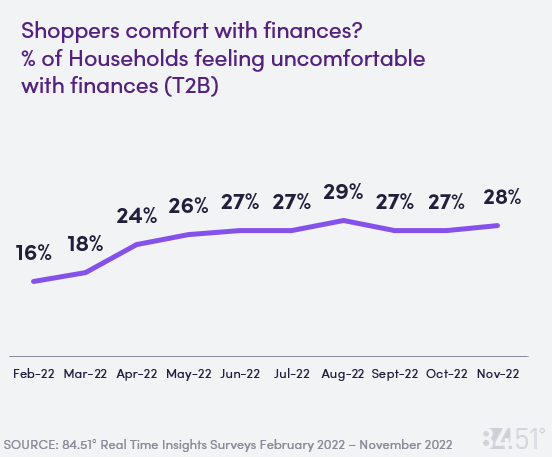

While shoppers’ concern over COVID is at an all time low, inflation and financial concern are beginning to swell.

Shopper discomfort over finances and their concern with inflation have increased from what we saw last month.

Only 14% of shoppers reported being concerned over COVID this month – the lowest concern we have seen to date.

According to the CDC, weekly average reported cases have slightly increased over the past 3 weeks.

While 85% of shoppers think a recession will happen in the near future, 48% feel a recession is happening now.

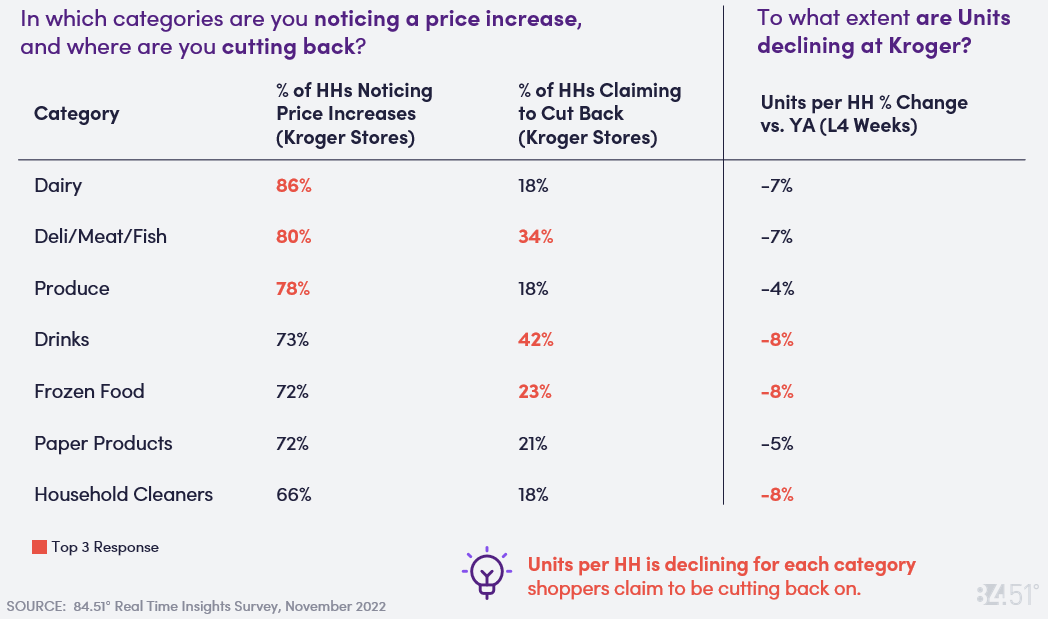

With shoppers still seeing high prices at the shelf, 65% of them have been looking for sales/deals/coupons, 61% are cutting back on non-essentials like snacks and candy, and 39% are purchasing fewer items on their grocery trips.

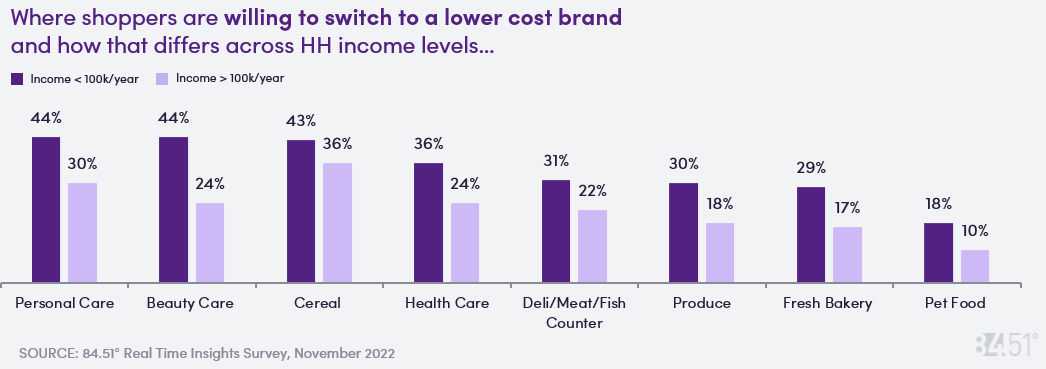

Only 10% of shoppers say they are not willing to switch to a lower cost brand in any category – 52% claim they have switched to a lower cost brand more often than they normally do.

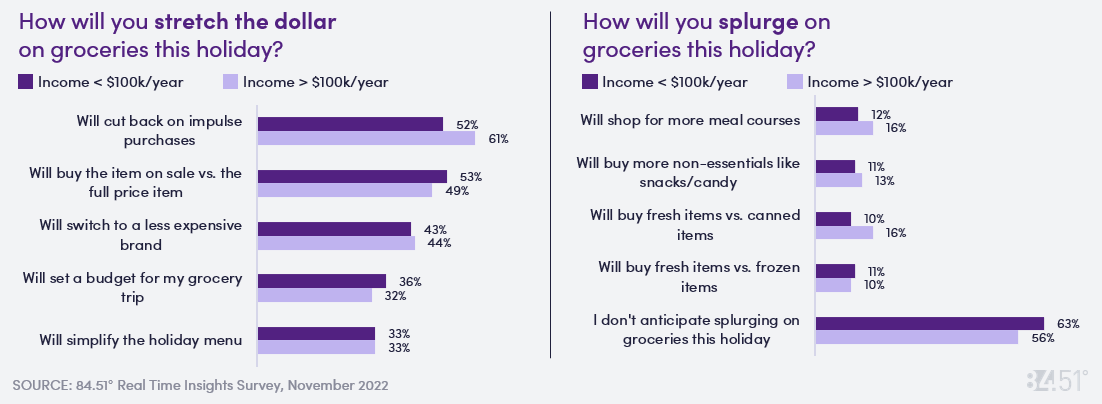

Top behaviors to help save during the holidays include cutting back on impulse purchases, buying items on-sale vs. full price and switching to less expensive brands - these behaviors are relatively consistent across income groups.

62% of shoppers do not have plans to splurge on groceries this holiday, but for those who will splurge, they plan to do so via additional meal courses, non-essential items, and switching to fresh items.

79% of customers will use loyalty cards the same amount or more during the holiday season vs. other times of year, increasing in use more than membership cards or store/retailer credit cards.

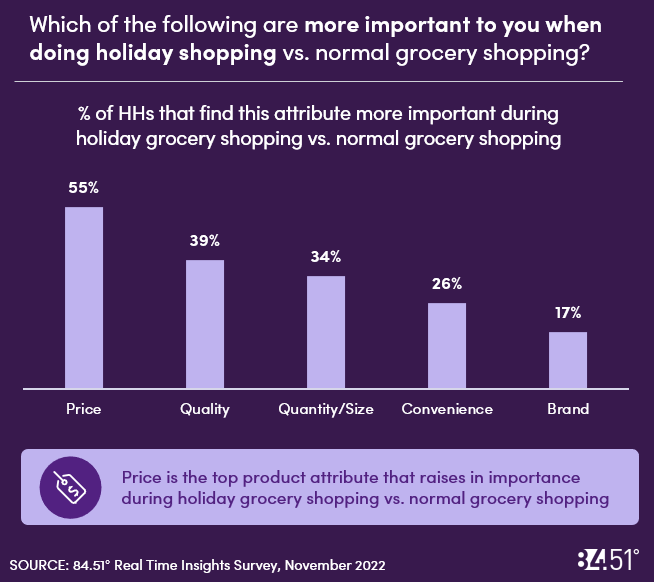

When shopping for holiday groceries, product attributes such as Quality and Quantity/Size become more important to shoppers, as well as Price which leads as the most important.

On the other hand, 31% of customers claim they make the same considerations as usual when holiday shopping, so attribute importance doesn’t change.

Shoppers plan to use a similar mix of modalities (in-store vs. online) when holiday grocery shopping and shopping for standard grocery items this season.

As of 11/8, only 4% of shoppers have completed holiday shopping and 60% have not yet started holiday shopping at all.

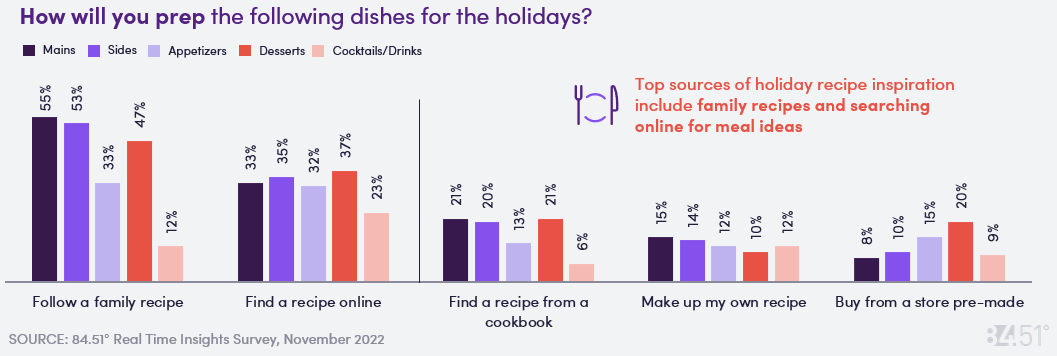

42% say their cooking enjoyment increases during the holiday season, while 34% report their grocery shopping enjoyment decreasing during holidays – find ways to make grocery shopping easier since this becomes more stressful for customers.

72% of shoppers will serve/eat Turkey as their main course this Thanksgiving, while 12% plan to use Ham as their main course and 6% use Chicken.

After holiday meals, 78% of shoppers plan to eat leftovers immediately, and 41% use them to make other types of meals.

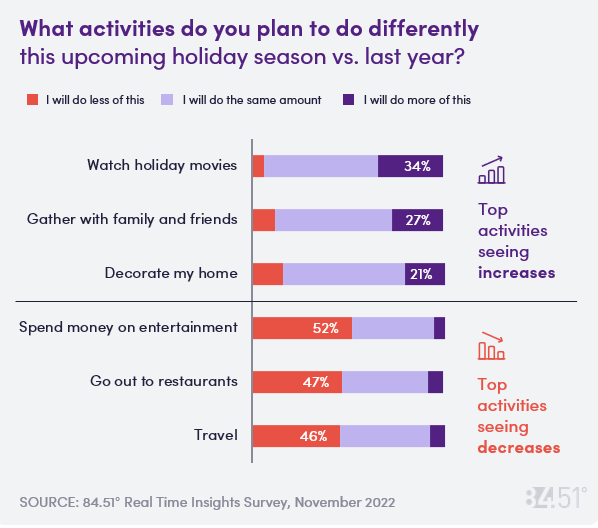

Most gatherings are staying the same or growing this holiday – 24% of shoppers plan to gather with more people this upcoming holiday season, while 59% will gather with the same amount as last year.

Shoppers are shifting activities this season, and planning to do less activities that are perceived as costly

What are you planning to set as your New Year’s Resolution in 2023?

45% plan to save more money

35% plan to eat a healthier diet

31% plan to reduce/eliminate debt

27% plan to spend more time with friends/family/partner

26% plan to improve their sleep

SOURCE: 84.51° Real Time Insights, November 2022

Visit our knowledge hub

See what you can learn from our latest posts.