Untapped Gen Z health opportunities for brands

In recent years, consumer behavior has shifted towards prioritizing health and wellness. Our research shows rising sales of value-added produce, high protein liquids/powders and workout supplements, as well as an opportunity for CPG brands to provide more healthy options. Consumers, especially Generation Z consumers, report an interest in finding healthy meals for themselves and their households.

The health-conscious consumer

Value-added, or pre-cut/pre-washed produce, high protein liquids/powders and workout supplements saw triple-digit dollar sales percentage growth compared to last year. Value-added vegetables alone saw a 569% increase (source 84.51° Stratum latest 52 weeks, ending 2/17/24). This surge in demand suggests consumers are actively seeking convenient and nutritious options to support their health and wellness goals. When it comes to making informed food choices, consumers are paying close attention to product labels. The most important information on product food labels according to surveyed consumers are:

43%: Guaranteed fresh

43%: Good for your health

42%: Nutritional value

39%: Gives you energy

37%: Strengthen immunity

Source: 84.51° Real Time Insights, January 2024

Finding healthy meal options

Consumer demand for transparency and health-related information reflects a growing awareness of the impact of diet on overall well-being. Additionally, our research shows that some consumers are seeking more healthy meals to prepare for themselves and/or their households.

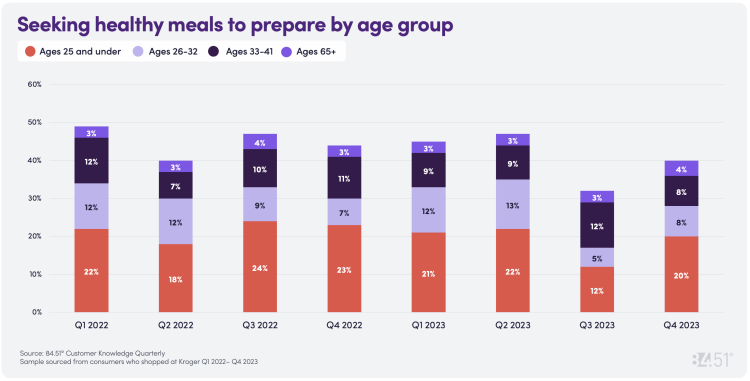

Consumers ages 65+ consistently reported the lowest difficulty in finding healthy meals to prepare for themselves and/or their household, with percentages ranging from 3% to 4% throughout 2022 and 2023. Consumers ages 26 to 41 also reported relatively low difficulty in finding healthy meals to prepare. The percentage fluctuates between 5% and 13% throughout the surveyed period. Consumers ages 25 and younger, i.e., Gen Z, on the other hand, reported the most effort in finding healthy meals to prepare for themselves and/or their households. While the percentage of consumers ages 25 and under seeking healthy meals fluctuates slightly over time, it remains consistently high, peaking at 24% in Q3 2022. This data indicates there's a clear opportunity emerging for brands to cater to the health-food demands of Gen Z and other consumers – especially when it comes to convenient, easy-to-prepare meal options that align with wellness goals.

As consumers prioritize healthier living, forging connections with health-conscious consumers will be critical. Even conventional "unhealthy" categories have a chance to disrupt and innovate by aligning with these powerful consumer currents. Winning brands will find ways to bake health into unexpected places, bridging the gap between cravings and wellness aspirations. Check out our infographic, Grocery retail trends to watch in 2024, to learn more about the holistic health trend as well as emerging trends.

Visit our knowledge hub

See what you can learn from our latest posts.