The spend or save dilemma: How today's shoppers make the choice

Recent market research has uncovered a paradox in consumer spending habits, where shoppers are seeking ways to save money and cut costs due to inflation, yet continue to invest in products they are loyal to, passionate about, or simply prefer for various reasons. These particular items appear to be resistant to the downward trend in spending that has been observed as the Consumer Price Index (CPI) has soared over the past two years. By utilizing the 84.51° Stratum and Real Time Insights platforms, a recent edition of the Consumer Digest offers a deeper understanding of this occurrence – identifying which items are and are not affected by the downward spending trend and more. We examine shoppers' preferences for national and store brands, identify the top products they're willing (and unwilling) to switch to store brands, and explore the reasons behind these choices.

National vs. store brand preferences

8% Prefer National Brand

29% Prefer National Brands but open to Store Brands

17% No specific Brand preferences

16% Prefer Store Brands but open to National Brands

31% Prefer Store Brand

Top commodities shoppers “say” they are willing to switch to store brands, though here’s what they actually “do”*

Frozen (+3.8%)

Shelf Stable (+1.7%)

Household Cleaning (-2.6%)

Healthcare (OTC) (+2.7%)

*Parentheses contain the sales percent increased or decreased. Source: 84.51° Stratum last 52 weeks ending 8/14/23

Top reasons why: willing to switch to store brands

Quality is just as good

Store Brands offer variety/selection that meets my needs

Store Brands offer product size(s) that meets my needs

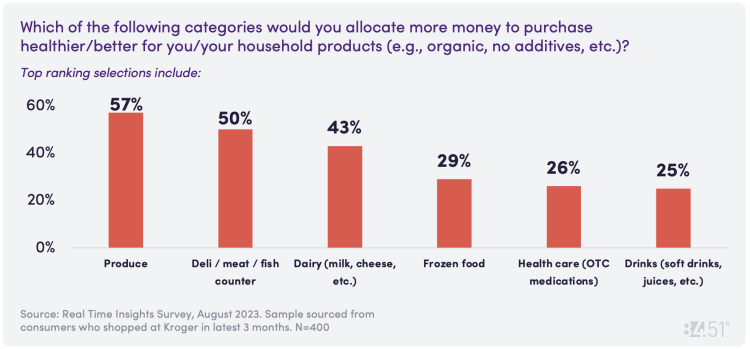

Spending on “better for you” products

Thinking of budgeting when shopping for groceries or household items, we asked:

Read the full report to find out why consumers are not willing to switch to store brands, the top 10 items that are purchased as a treat, plans for football watch/tailgating parties and many other insights.

Visit our knowledge hub

See what you can learn from our latest posts.