How 2021 grocery shopper trends affect 2022 hybrid buying habits

This article, originally published September 27, 2021, is part of the Spotlight US series, "Spotlight US: How consumers are wrestling with 2021's uncertainties.” Reprinted with permission by WARC.

Summary

Looks at changes in grocery shopping habits among US consumers as the COVID-19 pandemic stretches on.

Shopping habits and attitudes have vacillated thus far over the course of 2021, tied to different vaccination rates in different parts of the US, and the surprise of the delta variant, which tamped down early optimism about the US emerging from the pandemic this summer.

Because of uneven vaccination, different regions of the country are behaving somewhat differently, but many US grocery shoppers look to be hybrid over the long-term, combining in-store, pickup and delivery.

Especially given the variations in how people shop, winning brands will be those which know their customers better than their competitors and can respond quickly with quality data-driven insights and innovative approaches.

Why it matters

Every development during the era of COVID-19 has resulted in a change in grocery shopping behavior, but now some habits, like hybrid shopping, are becoming established patterns. However, there are regional differences in the US, depending on how COVID is impacting different parts of the country.

Takeaways

Switching easily between in-store aisles and e-baskets, the new hybrid grocery shopper demands retailers and brands meet them where they are.

Interest in e-commerce remains, but the reasons people use it remains fluid as the pandemic evolves; while many see less need to rely on e-commerce as a matter of personal safety, they will still turn to it out of convenience.

With the introduction of vaccines in early 2021, the percentage of pickup and delivery shopping trips began to decline across most states, but the rate of that decline differed from region to region as the gap in case numbers grew between states with high vaccination rates and those with low ones.

There is continued price sensitivity in the US, with 66% of shoppers reporting groceries were more expensive than they were the month before, and as many as 87% noticing higher prices for meat and seafood and 67% for produce.

Change, as Heraclitus once said, is the only constant in life. As the impacts of COVID-19 on the grocery industry continue to unfold, those words have never rung more true. Every development—from the spring 2020 lockdowns, to last winter’s surge, to the vaccine rollout, to the arrival of the delta variant—has triggered shifts in shopper trends, behavior and sentiment. And those shifts are becoming more regionalized as the gap in COVID case levels widens between states with high and low vaccination rates.

And that gap is wide. According to September 14, 2021 data from The New York Times, Tennessee, with a 43% vaccination rate, had the highest daily average of cases in the US, at 160 per 100,000; Maryland, with a 63% vaccination rate, had the lowest of the 50 states, with 18 cases per 100,000.

Within this fluid environment, a profile has emerged of the current grocery shopper gleaned from 84.51° behavioral analytics and consumer research. Switching easily between in-store aisles and e-baskets, this new hybrid shopper demands retailers and brands meet them where they are.

Choice is good. Those who offer frictionless options and customer-first strategies will win.

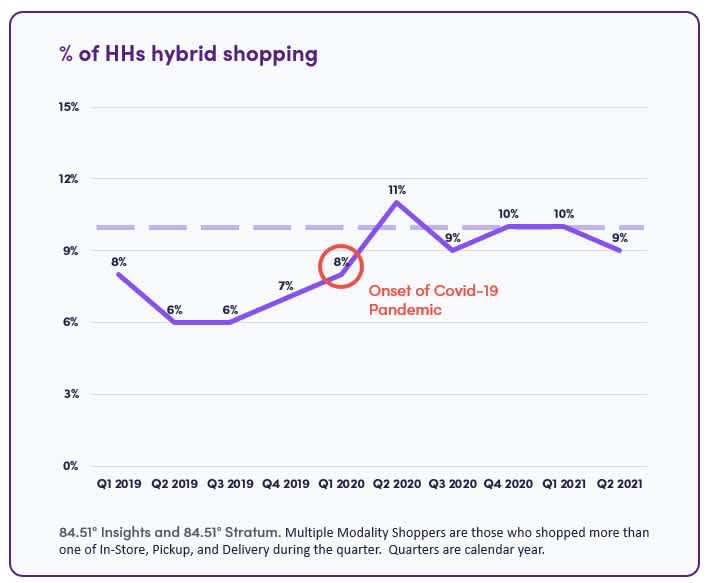

The hybrid shopper is here to stay

E-commerce was already gaining a foothold before COVID-19 (usage more than doubled between late 2019 and early 2020), but the arrival of the pandemic greatly accelerated its adoption. Digital sales grew 116% throughout 2020, as grocery shoppers became more comfortable with all the options available to them: in-store, pickup, delivery and ship. The second quarter of 2020, in fact, saw a huge surge in multimodality shopping as consumers stayed home, stocked up and searched for items in short supply. (Source: 84.51° Stratum – Modality Reports)

About the author Barbara Connors is VP, Commercial Insights at 84.51°. A subsidiary of Kroger, the company is a retail data science, analytics and media company that works with the grocer and other companies.

Visit our knowledge hub

See what you can learn from our latest posts.