Making the grade: Back-to-school shopping insights

The first bell has rung and students are back in their seats. With the back-to-school season in full swing, there is much that CPG brands can learn and act on from ongoing sales and shopping patterns. We’ll analyze post-kickoff consumer trends to spotlight key takeaways for brands seeking to connect with families amid the hustle and bustle of the school year.

Inflation is weighing heavily on the minds of Americans. For parents of students, 51% say that they are cutting back on school supplies and items due to inflation and rising prices and 52% plan to re-use items from last year, according to an 84.51° Real Time Insights survey.

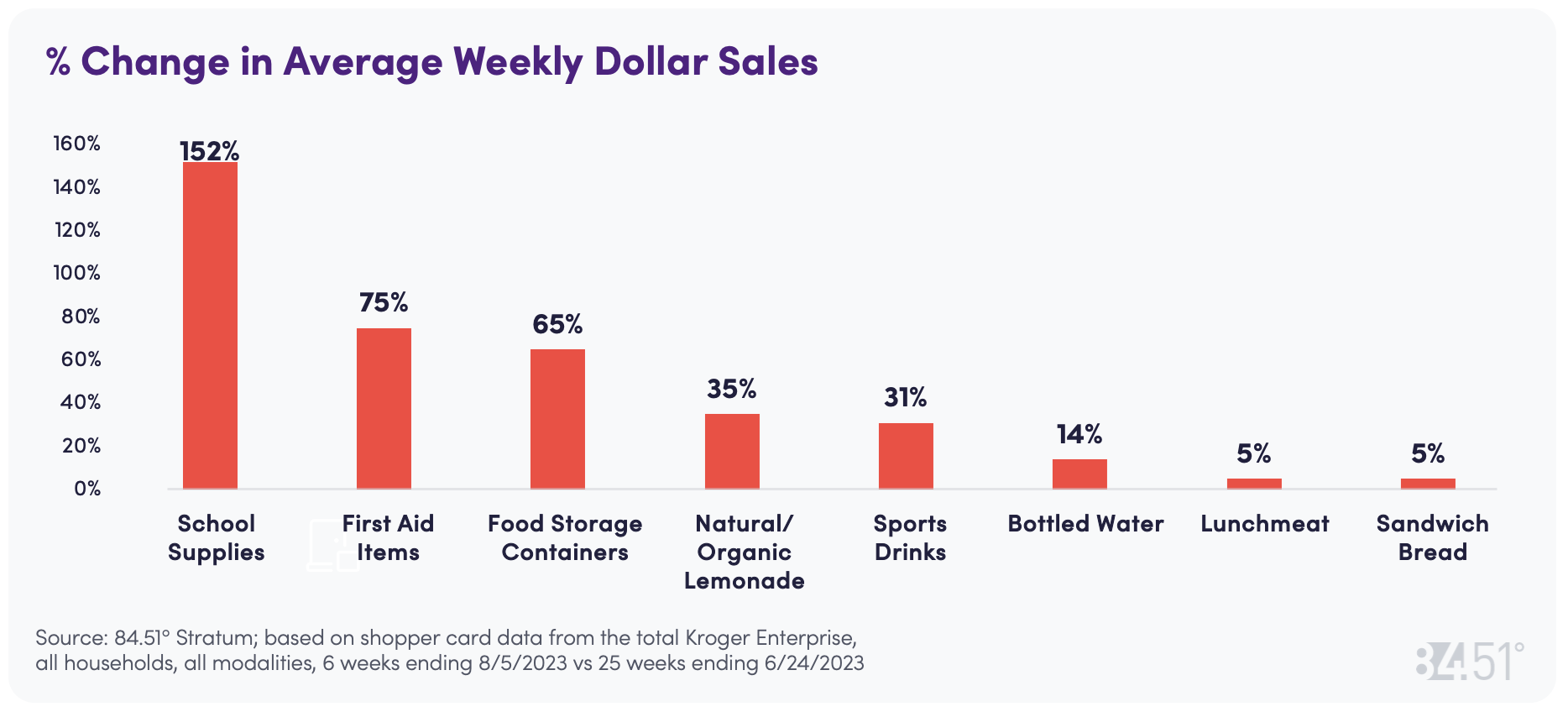

Early indicators, however, suggest that shoppers might not be walking the talk. Shoppers are buying more school supplies, even though over half of them said they planned to re-use items. School supplies sales are up 152% in average weekly sales compared to pre-season sales, followed by first aid items (+75%) and food storage containers (+65%).

Source: 84.51° Stratum; based on shopper card data from the total Kroger Enterprise, all households, all modalities, 6 weeks ending 8/5/2023 vs 25 weeks ending 6/24/2023

Takeaway: While customers say they need to reduce spending, they’re less willing to cut back on school supplies, despite inflation. This suggests parents are prioritizing student needs. For CPG brands, showing how your products provide quality and meet student needs could resonate with shoppers.

In-store or online? It depends!

When it comes to where shoppers are purchasing school supplies, they’re utilizing an omnichannel approach. For non-edible school items, 95% of sales are in-store compared to 5% of online sales. On the other hand, 14% of back-to-school snacks and meals are purchased online.

Speaking of online sales, shoppers appear to be using ecommerce as a one-stop-shop for their back-to-school purchases. Shoppers buying school supplies online are more focused on checking everything off their student’s list; they’re often also purchasing tissues, cleaners, foils & wraps, prepackaged lunch meals like Lunchables, and easy-to-pack fruits.

In contrast, in-store shoppers have a broader list; in addition to school supplies, they often have impulse items such as toys, cards and seasonal merchandise in their baskets.

Takeaway: Compared to in-store school supply shopping, online shopping is more focused and deliberate. Digital shopping carts could indicate a high purchase intent – use online product recommendations to surface complementary items and optimize product search to make reorders easy.

In-store school shopping trips present impulse purchase opportunities. Collaborate with category managers to have seasonal items, snacks, toys and cards prominently displayed around school supplies. Offering in-store coupons that link school essentials with seasonal treats could also be a strong cross-selling opportunity.

Do your homework: Know the customer

Brands meeting shopper needs across channels will come out ahead in the back-to-school season and school year. Making shopping efficient with online options while still offering complementary, seasonal items in stores is likely to appeal to today’s omnichannel shoppers. Overall, brands that understand the evolving priorities of back-to-school shoppers and adapt their offerings and messaging accordingly are poised for success this season.

Visit our knowledge hub

See what you can learn from our latest posts.