Consumer Digest: May 2022

Welcome to the May edition of the Consumer Digest, where we aim to provide relevant, informative and actionable insights around consumer trends and what consumers value. This month, we look at what’s more concerning for shoppers between COVID and inflation, how shoppers are adjusting their behavior as grocery store prices increase, summer vacation plans and the what, where and why behind snacks and sweets.

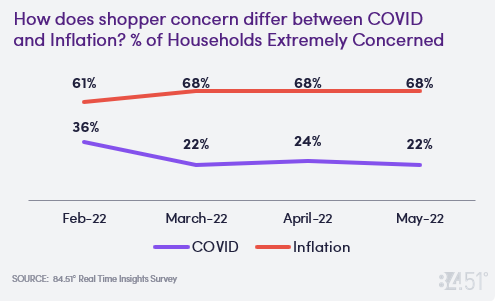

Competing for shopper concern – COVID vs. Inflation

Shopper concern around Inflation this year has been 2-3x that of their current concern about COVID:

Shoppers in the 45-54 age range show the most concern with Inflation, with 78% of that group being extremely concerned.

This group also shows the most concern about COVID at 31% extremely concerned.

In comparison, 59% of Shoppers under the age of 34 cite being Extremely Concerned about Inflation versus 13% of those Shoppers being extremely concerned about COVID.

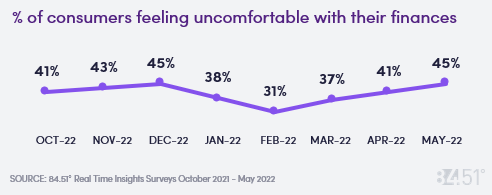

Almost 50% of Shoppers claim they are at least somewhat uncomfortable with their finances, which mirrors sentiment seen during the winter Holiday season.

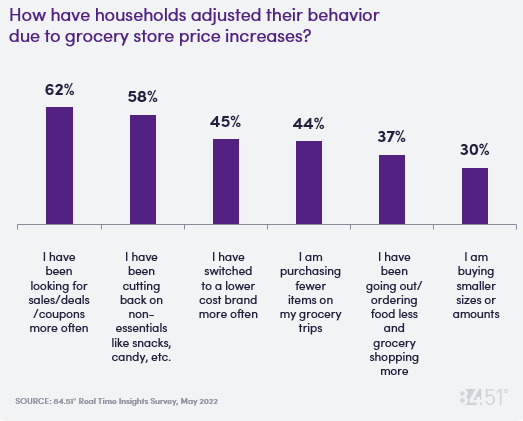

Rising prices and inflation – How it’s impacting consumers

Consumers are looking for ways to cut back cost more often now to combat rising prices, especially by looking for coupons/deals and cutting back on “non-essentials”.

This is especially true for lower income families – 67% of households making less than $50K per year are looking for these deals, compared to only 58% of households making over $100K.

So far this year, shoppers who are more value conscious are trending behind overall shoppers in trips per household and dollars per trip in snacking categories like chips, crackers and cookies.

40% of shoppers say that when choosing a store, finding one with “extra perks” designed for them to save money at least somewhat describes their behavior.

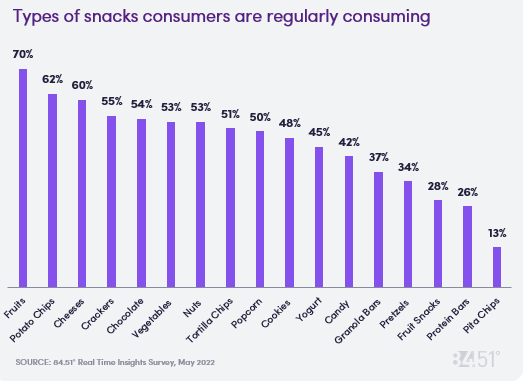

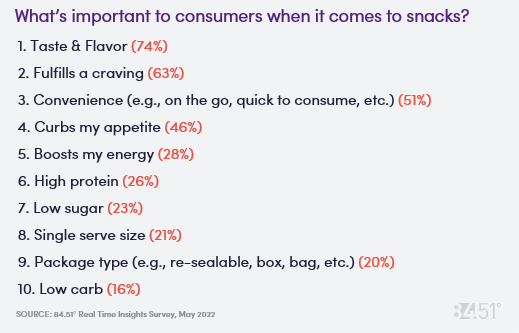

What consumers are snacking on

Consumers reach for a variety of items to snack on – healthy snacks (e.g., natural & organic, simple ingredients, low sugar, etc.) are very to extremely important to ~28% of consumers.

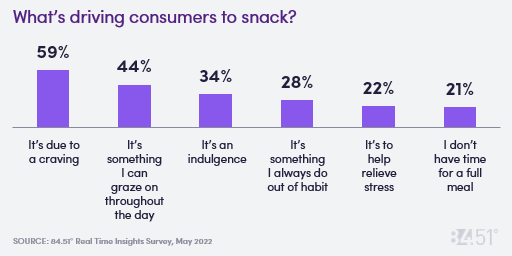

The why behind snacking

There are many occasions that consumers are snacking. Most often, it’s at home.

Among the top snacks being consumed at home are vegetables (98%) and fruit (96%). 95% of the time, households consume cookies, chocolate, and cheeses at home.

Typically, “on the go” ranks #2 for location of snack consumption. Protein bars are highest of the snack types eaten this way with 70% on the go.

Snacks that are being consumed most often “in between meals” include nuts (62%), potato chips (57%), fruit snacks (56%) and crackers (53%).

Consumers are buying their snacks at the grocery store (89%), mass retailers (68%), Club stores (32%), and online (Amazon, Walmart.com, Target.com, etc.)(21%).

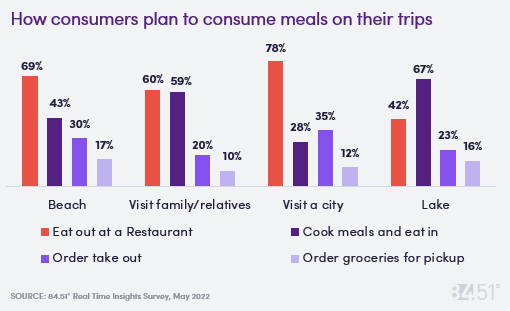

R&R This summer – It’s on!

While 23% of consumers are planning to not travel this summer, 35% plan to take a trip to the beach, 34% are planning to visit family/relatives, 28% are planning to visit a city, and 26% are planning to visit a lake.

Many are planning to spark up the grill this summer. 72% plan to grill hamburgers/cheeseburgers, 68% plan to grill chicken, 62% plan to grill hotdogs, and 43% plan to grill vegetables (e.g., mushrooms, peppers, eggplant, etc.).

SOURCE: 84.51° Real Time Insights, May 2022

Visit our knowledge hub

See what you can learn from our latest posts.