Research shows shifting plant-based shopper spending behaviors and motivations across plant-based and animal-based food categories

The first-of-its-kind research aimed to understand plant-based shopper behavior and consumer sentiment to identify whether shoppers are shifting away from their animal-based foods spend and increasing plant-based foods spend and if so, why.

WASHINGTON – Plant-based food sales in the U.S. hit a record $7.4 billion in 2021, and new consumer research to better understand shopping behaviors could accelerate the industry’s growth. Kroger, collaborated with the Plant Based Foods Institute (PBFI), sister non-profit to the Plant Based Foods Association, to conduct research for a new Plant-Based Foods Migration Analysis Report to understand plant-based shopper behavior and sentiment, leveraging 84.51° data science and insights.

“The research was conducted as part of Kroger's long-term strategy predicated on listening to their customers. Kroger is committed to learning from consumers and creating the optimal merchandising strategy for plant-based foods to best meet the needs of shoppers,” said Holly Adrien, natural and organics strategy and innovation manager at Kroger.

Summary of research findings:

95% of plant-based consumers surveyed said they increased or maintained their plant-based spend versus the prior year**.

In year two, plant-based consumers generally decrease or maintain their level of spending on animal-based foods, which shows a reversal from year one (COVID timeframe) spending*.

43% of plant-based customers increasing or new to plant-based products choose plant-based milks over conventional dairy milk**.

Customers who buy plant-based foods are motivated by personal health concerns (such as cardiovascular or cancer concerns) and 49% state they believe plant-based alternatives are healthier than animal-based foods***.

***Note that this is reflective of surveyed plant-based consumer beliefs/motivations.

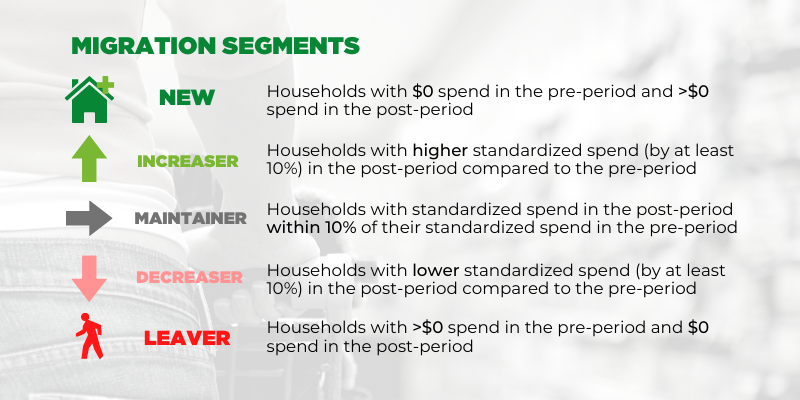

The Plant-Based Foods Migration Analysis, part one of the research, measured changes in plant-based customer spending in animal-based and plant-based foods across five categories – milk, refrigerated and frozen meats, frozen meals, cheese, and yogurt, and revealed consumer shifts in engagement with each grocery segment. In part two, a comprehensive Plant-Based Foods Survey, explored plant-based consumer motivations for these shifts. This collaboration between PBFI, Kroger, and 84.51° demonstrates a shared commitment to better understand and serve customers looking for plant-based foods. The comprehensive research evaluated purchases by nearly eight million households over two years and categorized shoppers into five segments, ranging from shoppers new to the plant-based category to shoppers leaving the category. These segments are: New, Increasing, Maintaining, Decreasing, and Leaving plant-based foods.

Year-over-year sales of plant-based foods at Kroger increased 1.5% from 2020 to 2021, after a 24% increase from 2019 to 2020*. Findings from the report indicate plant-based engaged households that purchased plant-based foods from 2020 to 2021 typically decreased or maintained annual spending for animal-based foods. The average plant-based household that either maintained or increased their spend with plant-based foods, decreased their spend with animal-based foods by up to $28.21. According to 84.51°, this suggests that households buying plant-based foods continue to substitute more animal-based products with plant-based alternatives over time and that the increasing popularity of flexitarian diets may reduce conventional meat consumption.

“One of the ways we can measure the impact of plant-based foods is to understand the displacement of animal-based foods in favor of plant-based foods through comprehensive research,” said Julie Emmett, senior director of marketplace development for PBFI. “We must remove barriers for consumers by understanding shopper dynamics and taking an evidence-based look to ensure shoppers can easily find their products of choice. We appreciate our long-standing collaboration with Kroger and its willingness to share these results on behalf of the industry.”

The study also provides insights into plant-based category performance and offers a blueprint for understanding which plant-based foods are associated with high engagement within the overall category. For example, plant-based shoppers who increased their plant-based cheese purchases also had the highest total spend in the plant-based foods category, while also being less engaged with animal-based foods. This means plant-based cheese shoppers are some of the most dedicated to the plant-based lifestyle.

In addition to the observed shift in spending, the research included a survey of plant-based shoppers to better understand the motivations behind the changes. About 95% of plant-based consumers surveyed said they increased or maintained plant-based consumption versus the prior year. Among the Plant-Based Increaser segment:

43% report choosing plant-based milk instead of animal-based milk

Nearly 30% are choosing refrigerated plant-based meat and frozen meals instead of animal-based items in the same categories

Nearly 20% are choosing plant-based cheese and yogurt instead of animal-based products in the same categories.

Surveyed Plant-Based Increaser households attribute health as the leading reason why they are increasing their plant-based consumption, with 54% citing personal health concerns (such as cardiovascular or cancer concerns) and 49% state they believe plant-based alternatives are healthier than animal-based foods. *

Among Plant-Based Decreasers that were asked what would make them more likely to consume plant-based, 64% say lower pricing and/or more frequent sales and coupons, and 58% say better taste and/or texture. For Plant-Based Increasers, when asked how shopping could be made easier, 61% stated price promotions and 29% said that recipes would be helpful.

“This research is a continuation of our years-long collaboration with PBFA using 84.51°’s robust data science to analyze plant-based food sales and the plant-based shopper to gain a holistic view of this market,” said Catherine Cowan, insights account manager at 84.51°. “We look forward to using these findings as a benchmark to understand future growth of the category.”

This research serves as the benchmark for annual follow-up studies to evaluate customer engagement between plant-based and animal-based foods. Given the dynamic nature of the plant-based foods industry, further exploring how to merchandise and promote plant-based foods will help the entire industry understand best practices and assess strategies for action.

To access the full report and findings, click here.

Charts for media use can be accessed here.

About the Plant Based Foods Institute The Plant Based Foods Institute (PBFI), PBFA’s sister non-profit organization, is focused on driving plant-based food system transition through policy and business strategies. Driving this transition requires a holistic approach that recognizes the complexity of the challenges we face, builds bridges across sectors, and ensures businesses can thrive—and it requires solutions that work for a diverse coalition of food system participants. That’s why PBFI incubates, implements, and evaluates strategies that empower the broadscale change we need, through the power of plant-based.

About 84.51 84.51° is a retail data science, insights and media company helping The Kroger Co., consumer packaged goods companies, agencies, publishers and affiliated partners create more personalized and valuable experiences for shoppers across the path to purchase. Powered by cutting edge science, we leverage 1st party retail data from nearly 1 of 2 U.S households and 2BN+ transactions to fuel a more customer-centric journey utilizing 84.51° Insights, 84.51° Loyalty Marketing and our retail media advertising solution, Kroger Precision Marketing.

About the research Kroger collaborated with the Plant Based Foods Association to conduct broad, two-part research to understand actual plant-based shopper behavior and consumer sentiment, leveraging 84.51° data science and insights expertise.

Part 1*

Migration analysis tracked shopper behavior of 8MM households over 2 years (Year 1: 2019 to 2020 compared to year 2: 2020 to 2021 across five plant-based categories and five animal-based categories (milk, fresh and refrigerated meat, frozen meals, cheese, yogurt). This benchmark study will be conducted in future years to track consumer interactions with plant-based foods as a whole and animal-based foods to better understand the shifts between them.

Part 2*

Consumer survey to households who are in the Plant-Based Engager Segment. The goal was to understand shopper attitudes and sentiments among the sub-segments of plant-based Increaser and Decreaser households to better anticipate future trends for the plant-based category. 84.51 Real-Time Insights 2022.

Visit our knowledge hub

See what you can learn from our latest posts.