Understanding SNAP shoppers after pandemic aid expires

Pandemic-related allotments recently ended for recipients of the U.S. government’s Supplemental Nutrition Assistance Program, typically known as SNAP. New legislation is being introduced with the goal of bringing the food benefits to more people. Additionally, a bill aiming to expand food assistance for tribal households was recently introduced in the U.S. Senate, as was legislation that would allow striking workers to receive SNAP benefits during work stoppages.

As efforts to expand SNAP benefits continue, a recent edition of the Consumer Digest offers insights into the effects of the end of the emergency allotment (EA) payments. From concerns over inflation to how and where consumers use their benefits, we highlight recent trends in SNAP shopper experiences, attitudes and expectations.

Roughly 42 million people are currently receiving SNAP benefits. Our research found that 76% of SNAP households surveyed are extremely concerned about inflation after the expiration of their SNAP EA benefits, compared to 63% of the general population who are extremely concerned about inflation.

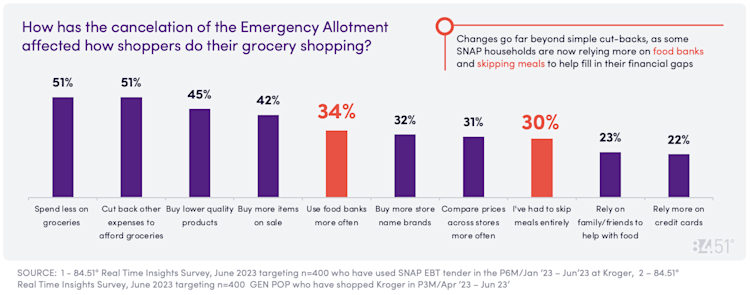

More than 60% of SNAP households reported the change is having a significant impact on their ability to afford groceries. As a result, 51% said they are spending less on groceries and cutting back on other expenses to afford the groceries they do buy.

Our research revealed that when using their SNAP benefits, shoppers are more likely to cut spending on discretionary items including Snacks/Candy, Deli/Meat/Fish, Fresh Bakery and Drinks, compared to the general population.

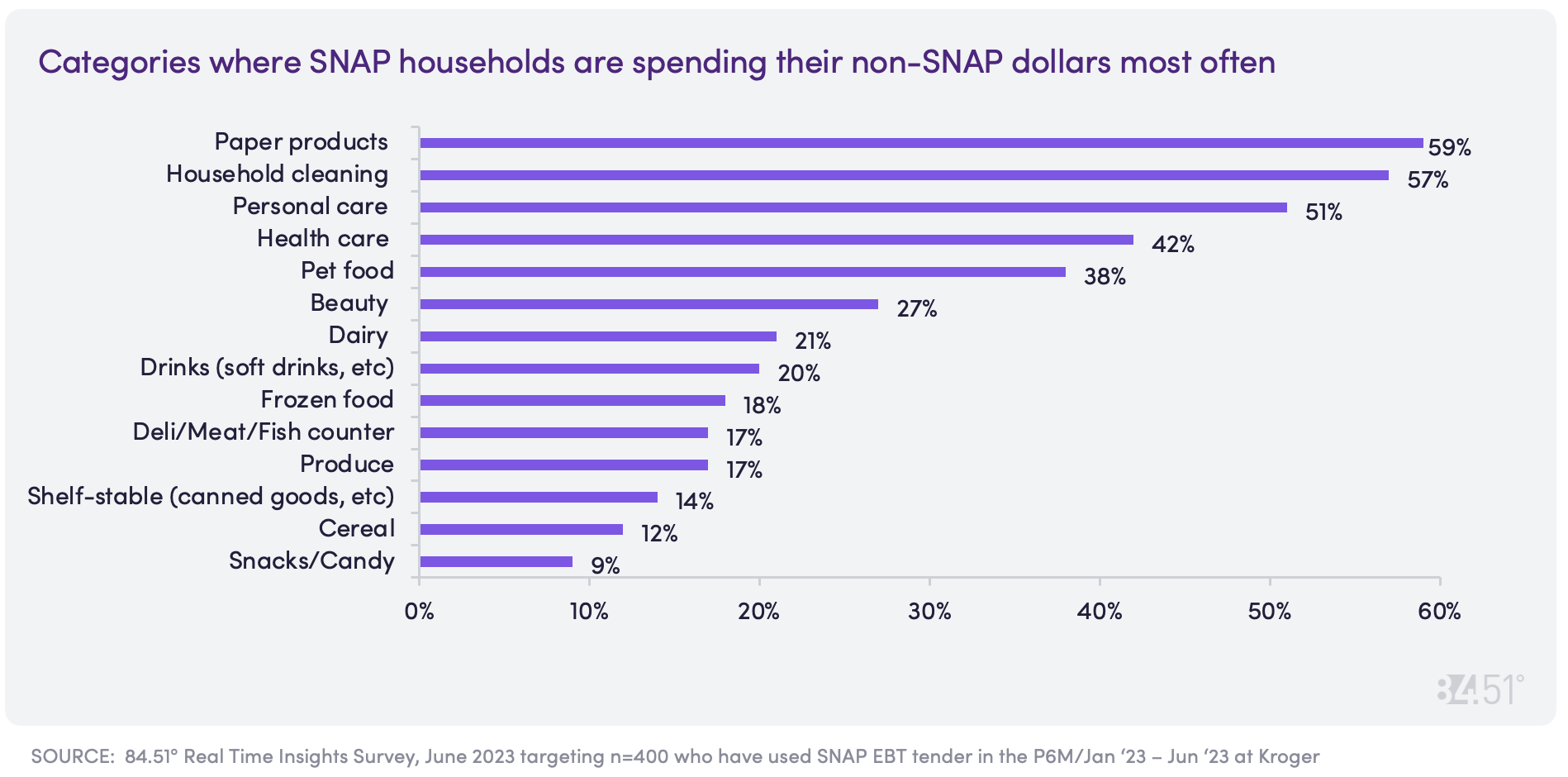

And when purchasing items not covered by their SNAP benefits, categories important to SNAP shoppers include Paper Products, Household Cleaning, Personal Care and Health Care.

No matter what the source of their spending is, promotions that SNAP households say give them the most value include digital coupons (57%), weekly digital deals (47%) and BOGO offers (41%).

SNAP households will continue to watch their budgets in the face of EA cuts and ongoing inflation. For more insights on how to meet the wants and needs of these shoppers, read the full report.

Visit our knowledge hub

See what you can learn from our latest posts.