Research: Large packs dominate consumer preferences

Consumer preferences are constantly evolving – yet some remain consistent over extended periods of time. Research that we conducted on shopper preferences from Q2 2021 to Q4 2023 revealed several trends regarding pack sizes and what influences decisions on where to purchase groceries. Staying attuned to shopper patterns such as these is key for making informed decisions to meet consumer needs in a dynamic grocery retail market.

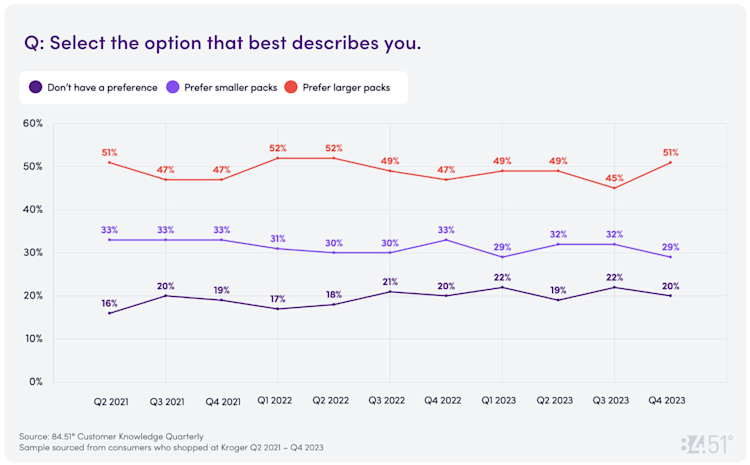

Preferred pack sizes

From Q2 2021 to Q4 2023, a significant percentage of shoppers consistently preferred larger packs, with this preference hovering between 45% and 52%. This indicates a general trend where, while fluctuations occur, the majority leans toward larger pack sizes.

On the other hand, the preference for smaller packs ranged between 29% and 33%. The peak preference for smaller packs was consistently observed at 33% during several quarters. This suggests that a substantial, albeit smaller, consumer base consistently opts for smaller packs.

Interestingly, the percentage of shoppers without a specific preference for pack size has shown a gradual increase, ranging from 16% to 22%. This upward trend indicates a growing segment of shoppers who are flexible regarding pack size, highlighting an opportunity for brands to offer versatile pack options.

Selecting a grocery store

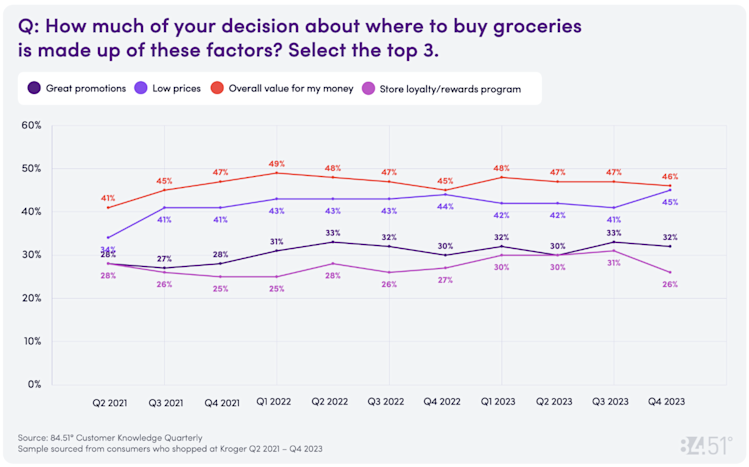

When deciding where to shop for groceries, shoppers consistently say their top priority is overall value for money, more so than great promotions, low prices or store loyalty reward programs. Except for a slight dip in Q4 2022, the percentage has remained stable, rising from 41% in Q2 2021 to 46% in Q4 2023. This highlights the enduring importance of value in purchase decisions.

Low prices are the second most important factor, with significant growth from 34% in Q2 2021 to 45% in Q4 2023. This increase suggests that price sensitivity among consumers has grown over time, making competitive pricing essential.

While promotions and sales ranked as less critical than overall value and low prices, they still play a significant role, with their importance ranging from 27% to 33%. The slight upward trend from 28% in Q2 2021 to 33% in Q3 2023 indicates that strategic promotions can attract price-sensitive shoppers.

Store loyalty and rewards programs are the least influential factors, with percentages ranging from 25% to 31%. However, there was a slight increase in their importance in Q1 and Q2 2023, suggesting that while these programs are less critical, they should not be neglected.

Trends over time

Analyzing these trends over time reveals several key insights:

Larger packs. While preference for larger packs remains strong, there's a slight decline from the early 2022 peak.

Smaller packs. Preference for smaller packs is stable with minor fluctuations, suggesting a steady market segment.

No preference. No preference for pack size is on an upward trend, which could suggest increasing consumer flexibility.

Overall value. This is consistently the topmost critical factor for consumers, with implications for brands and retailers to work together on communicating value.

Low prices. Maintaining competitive prices is also essential, as many consumers continue to be price sensitive.

Visit our knowledge hub

See what you can learn from our latest posts.