Frozen + Fresh = A Hot Combo for Omnichannel Shoppers

There’s a hot trend in the freezer aisle: Frozen sales are up nearly 19% over last year, outpacing total Kroger growth. And analytics gathered from shoppers’ online carts suggests they are buying frozen items as a complement to, rather than replacement for, fresh. That means there are great opportunities to leverage e-commerce customers’ buying habits to help them create more fresh meals at home.

How pandemic buying made frozen hot.

New freezer sales soared with the arrival of COVID-19 in spring 2020. The ability to stock up on frozen items ensured households had what they needed to create a steady stream of home-prepared meals in the wake of restaurant closures and shopping restrictions. One year later, they’re still filling those freezers. Frozen sales have remained high at +14% over the past 12 weeks (12 weeks ending 3/13/2021) and continue to outpace total store sales. We anticipate that trend will continue even as restrictions ease.

Vegetables lead frozen unit growth.

Frozen unit sales grew almost 8% over the last year, and Pickup and Delivery shopping drove that growth. Looking at the top-10 frozen categories with the highest absolute dollar increases over last year, four are ideally suited for use in fresh meals. These include frozen prepared chicken, frozen potatoes, frozen fruits, and the chart topper: frozen vegetables/vegetable dishes.

Frozen vegetables also scored the highest number of engagements or clicks online and had the highest add-to-cart rate of all frozen categories. That means households are looking for and purchasing frozen items that can be part of a meal that’s both convenient and healthy.

Watch your peas and queues.

When households search online in the frozen vegetables category, frozen peas are the top searched item followed by corn and broccoli. And they’re adding those frozen items at the end of the e-commerce cart-building process—likely a holdover habit from in-store shopping—even though there’s no practical reason for doing so online.

As they build their online carts, people are pairing their frozen vegetables with canned items, fresh produce like sweet potatoes and baby carrots, and meats like ground turkey and frozen chicken. This underscores that households buy frozen vegetables as part of a home-cooked meal, or as an ingredient based on complementary categories online. For instance, frozen vegetables are a top category in baskets that also contain salmon, tilapia, frozen prepared chicken, smoked dinner sausage and Asian foods.

Here are two pro tips for making the most of this intel:

By using 84.51° Stratum Basket: Products Bought Together, brands can explore the composition of baskets that contain peas and other popular frozen ingredients for recipe suggestions, strategic cross-promotion, and advertising direction.

Consider targeted onsite ads and other ways to ensure shoppers don’t forget to add frozen vegetables to their carts before checkout.

Frozen items expand options for fresh meals.

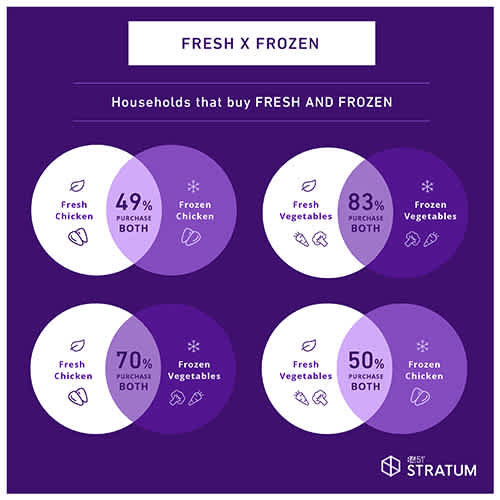

84.51° Stratum reveals that households often buy frozen foods to supplement their fresh counterparts:

Households that buy fresh and frozen This could indicate that people are looking both short- and long-term in their menu planning. It could also mean they seek the expanded options frozen items afford them to pull together a wholesome meal with ingredients they have on hand.

CPGs and advertisers should consider ways—like quick recipes and bundling opportunities—to help these households stock up and prepare meals. As we move into the warmer months, these might include main dish salads that combine a protein like chicken with a mix of fresh and frozen vegetables. It’s all part of broadening their understanding of what a fresh meal can be.

Help for high-convenience households

Households that prioritize convenience favor frozen foods and e-commerce. 84.51˚ data shows that households most focused on convenience over-index with pickup and delivery compared to in-store, while this household group over-indexes with frozen categories compared to total store.

Tellingly, while 18% of total Kroger households are households most focused on convenience, 47% of the engagements or clicks within the frozen prepared chicken category online are from households most focused on convenience. That said, all those clicks lead to a 31% purchase rate, which is slightly below total grocery benchmarks, so there is real opportunity to further convert these households. You could start by helping households most focused on convenience build out fresh meals to accompany their frozen chicken through recipe suggestions, bundle opportunities and digital coupons.

After a year that saw U.S. households adapt to, then settle into, new routines around home-prepared meals, the frozen trend shows no sign of cooling. Frozen and fresh companies alike can leverage these insights to win shopper interest by cross-promoting ingredients in the fresh and frozen space, respectively, that enhance online shoppers’ ability to create home-cooked meals that are appealing, healthy, and convenient.

Interested in more insights and activation opportunities? Reach out to your account managers or shopperinsights@8451.com.

Visit our knowledge hub

See what you can learn from our latest posts.