Consumer Digest: Snacks and sweets special edition 2022

Snack and Sweets Buying Trends: A Case of “Do as I Say, Not as I Chew?”

With inflation and the Consumer Price Index reaching 1980s levels, 45% of grocery shoppers surveyed in May say they’re feeling the pinch on their finances. To learn how rising prices are affecting their grocery planning, the 84.51° Insights team polled shoppers about their buying intentions. Their responses were then compared with first-party transaction data in key product categories – particularly the Snacks and Sweets space.

Did shoppers’ purchasing trends reflect their planning? Here’s a taste of the findings.

Have shoppers soured on Snacks and Candy? When asked how they’re coping with grocery store price increases…

52% of shoppers say they’ve noticed price increases in snacks and candy. While that’s significant, they’re much more aware of rising prices in the dairy (82%), produce (78%), and deli/meat/fish (77%) categories.

64% say they’d cut back on snacks and candy “if money was tight.”

But crunching the sales numbers reveals a sweeter story…

Snacks say “so what” to a weakening economy.

Sales have risen 9% to date 2022 vs 2021 across a wide variety of popular snacks that includes fruits and vegetables.

Rice cakes, with a 29% YTD sales jump, lead the snacking surge, followed by Multipack Snacks (23%), and berries (18%).

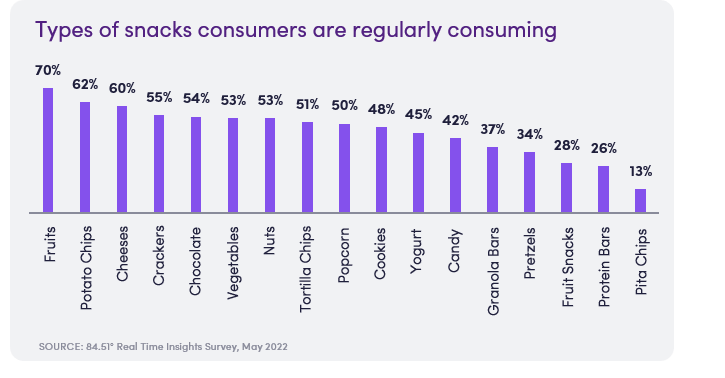

What are shoppers munching on – and why?

Fruit (70%), potato chips (62%) and Cheese (60%) lead the pack.

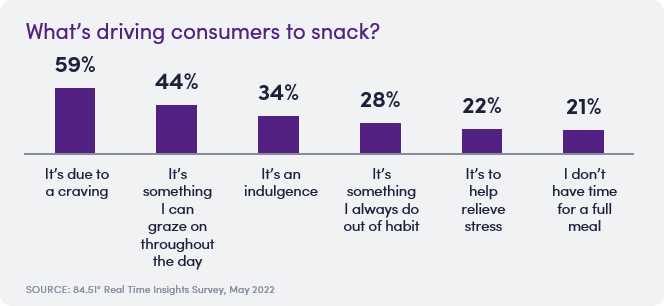

59% say “satisfying a craving” draws them to snacking.

44% say “it’s something I can graze on throughout the day,” and (34%) say it’s an indulgence.

Why it matters: Getting your place on the plate.

Knowing the nuances of shoppers’ snack and candy habits makes it easier to help them make better choices. For more actionable insights on snacking, download the report.

Visit our knowledge hub

See what you can learn from our latest posts.