Consumer Digest: October 2022

Welcome to the October of the Consumer Digest, where we aim to provide relevant, informative and actionable insights around consumer trends. This month, we're highlighting how consumers are gearing up for the holidays from shopping to meal planning and participation in events. We also see how consumers are planning for cold and flu season.

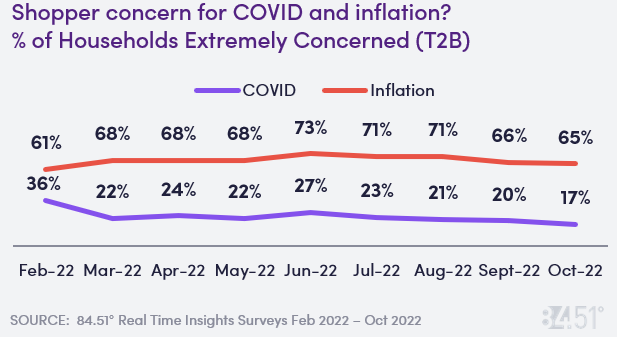

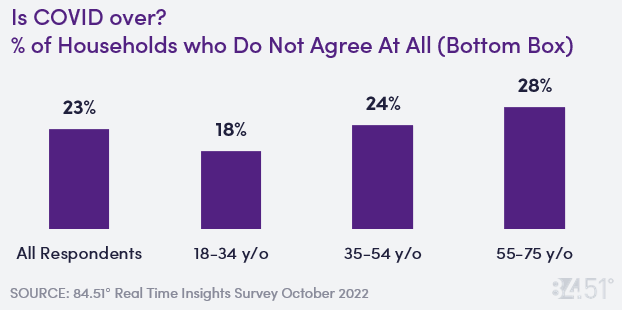

While shopper concern for COVID has steadily declined, almost a quarter of respondents do not agree at all that it is over.

Respondents 45-74 years old are especially more likely to not believe COVID is over.

Concern for the upcoming Flu season is lower than COVID concern, with 12% of respondents citing they are Extremely Concerned (T2B) about the Flu.

Inflation concerns remain steady compared to September, and this concern is especially pronounced with respondents 55-74 years old with 79% of them saying they are Extremely Concerned (T2B).

While over 50% of respondents still cite that they’d be willing to switch to lower priced brands in Shelf Stable, Household Cleaning and Paper products, there were notable increases (+6 percentage points or more) in respondents citing this willingness to switch in Dairy, Frozen Foods, Drinks and Pet food compared to September.

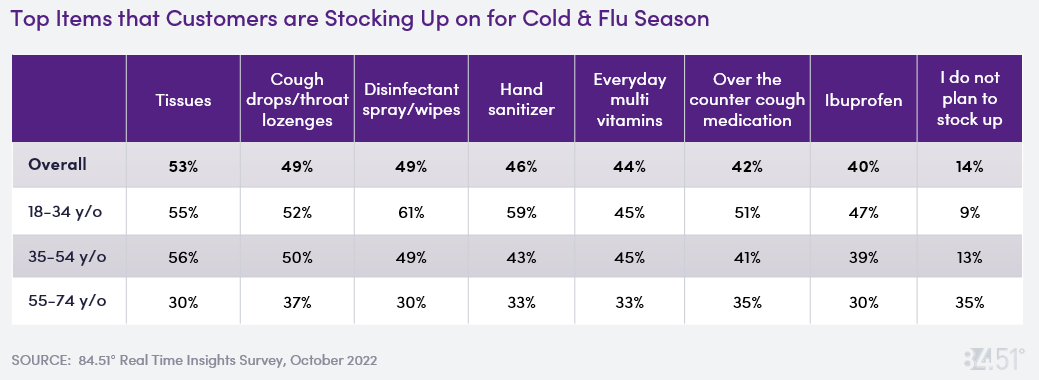

Tissues, Cough Drops and Disinfectants are the top items that shoppers are stocking up on to get ready for Cold & Flu season.

Shoppers 55-74 are less likely to stock up than those who are younger.

27% of Shoppers claim they will stock up on Natural Remedies for Cold & Flu.

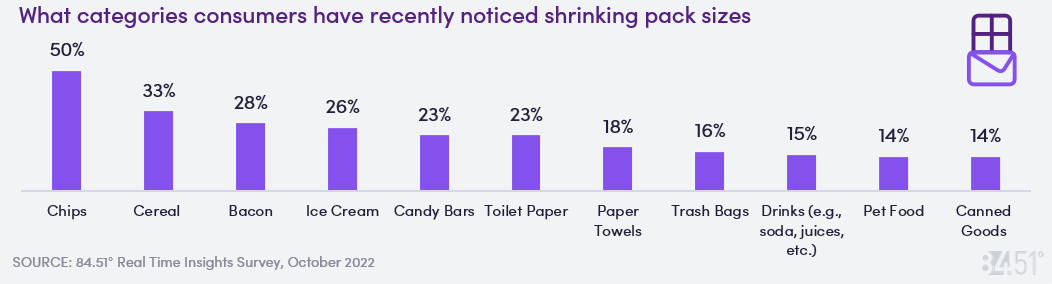

While 29% of shoppers say they have not noticed any categories that are shrinking pack sizes, 45% of shoppers who are noticing will buy a different brand that hasn’t reduced its size, 42% say they will buy it if they have a coupon, 17% won’t buy the item at all, and 10% will buy more packages to make sure they are getting enough product. 40% say they will still purchase the item with the reduced size.

Close to 75% of consumers are currently buying bulk items in categories like paper products (55%), household cleaners (dish soaps, surface cleaners, laundry detergents, air fresheners, etc.) (35%), shelf stable items (canned goods, pastas, etc.) (26%), and personal care items (22%).

Most often, shoppers are buying these items at a physical grocery store. Specifically in the frozen food category, shoppers say they typically purchase frozen food at a club store just as much as they do at a physical grocery store.

Shoppers with a HH income of less than $50k per year are purchasing fewer bulk items across the majority of categories when compared to those making more than $50k per year.

Many shoppers wait until the “last minute” to buy Halloween Candy.

30% of all Trips for Candy in the month of October last year happened in the 7 days leading up to and including Halloween.

17% of all Trips for Candy in the month of October last year happened in the last 3 days of October (including Halloween).

Almost 2/3 of customers claim they will celebrate Thanksgiving with the same number of people as last year, with those under 55 most likely to celebrate with more people than last year.

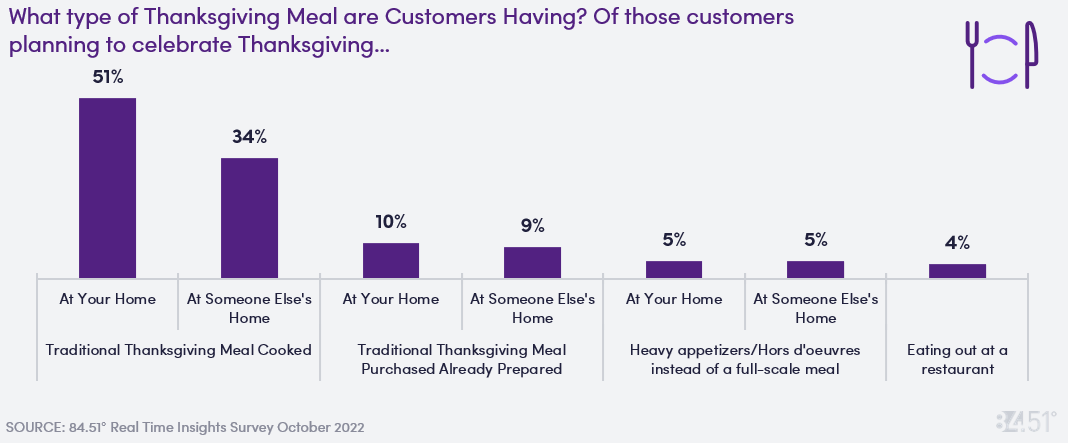

While most customers celebrating Thanksgiving will eat a traditional Thanksgiving Meal cooked at their/someone else’s home, more than 15% of customers will purchase a Thanksgiving Meal that is already prepared.

70% of customers say they will only shop in-store for their Thanksgiving meal, with the other 30% either exclusively online or combination of in-store and online shopping.

38% of shoppers will cut back on their Thanksgiving Meal due to inflation. Of those cutting back…

45% will cut Turkey or Pumpkin Pie

37% will cut Corn Bread

32% will consider Cranberry Sauce, Stuffing or Macaroni & Cheese

As of October, 25% of customers have already begun their Holiday Shopping, with another 57% beginning in the next few weeks to month.

9% will not shop until the final week before their Holiday, and another 10% do not plan to shop at all.

Cyber Monday is more popular with customers than Black Friday, and the gap is especially pronounced with those making over $100K per year. 69% of these customers plan to participate in Cyber Monday.

SOURCE: 84.51° Real Time Insights, October 2022

Visit our knowledge hub

See what you can learn from our latest posts.