Consumer Digest: May 2023

Welcome to the May edition of the Consumer Digest, where we aim to provide relevant, informative and actionable insights around consumer trends. This month, we are focusing on consumer’s snacking habits. We’ll look at how often consumers are snacking, top occasions when snack types are being consumed and reasons consumers are reaching for a snack. From there, we’ll look at how snacking habits have changed compared to a year ago. Finally, we’ll wrap up with how consumers are buying new snacks.

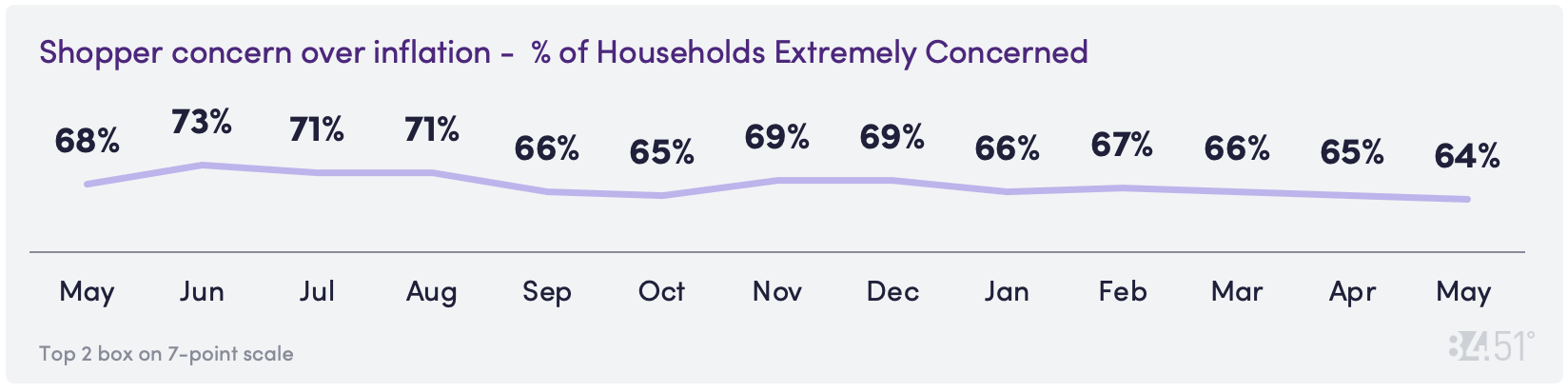

Is shopper concern over inflation diminishing?

Inflation concern drops to the lowest we’ve seen to date this month with 64% of consumers claiming they are highly concerned with inflation and consumer prices.

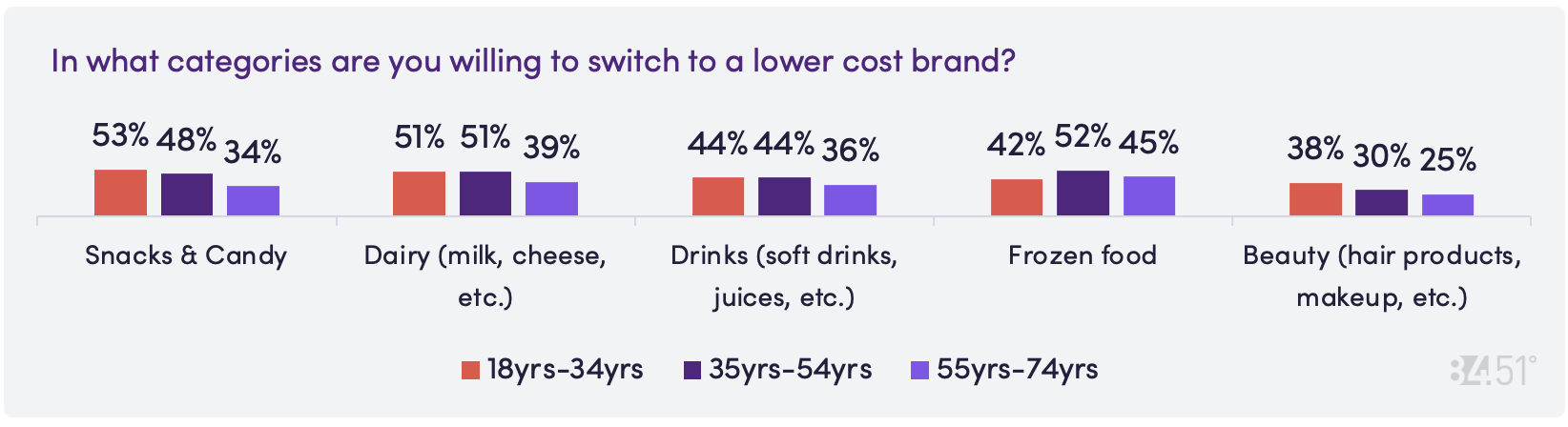

Younger shoppers are more likely to switch to lower cost brands across many commodities

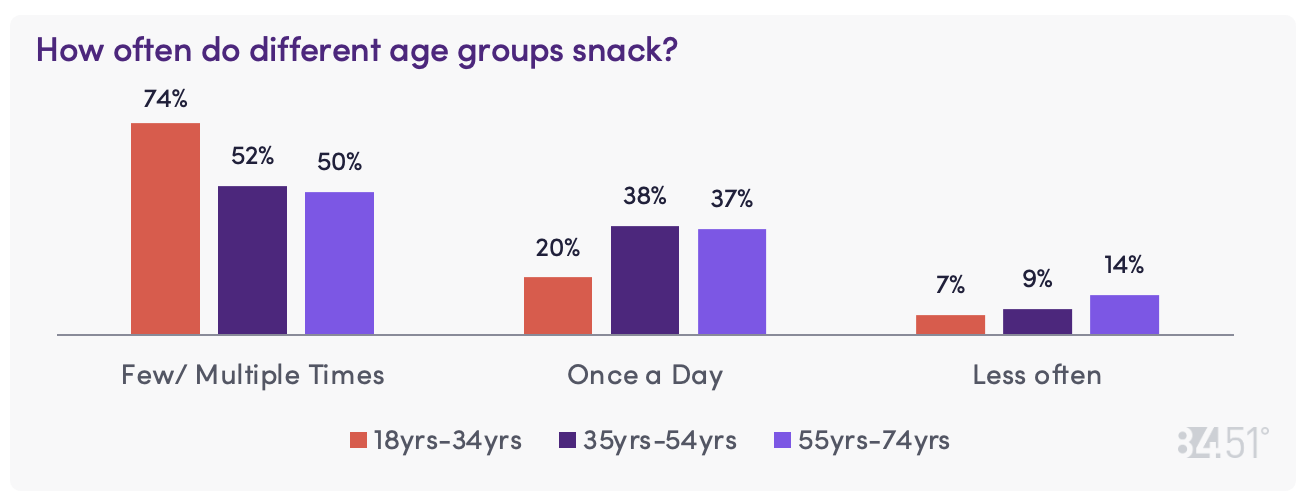

How often do consumers snack?

Younger consumers snack the most frequently, with 74% of those under 35 years old snacking at least a few times per day (compared to ~50% for those 35yrs and older).

56% of consumers say they snack all year round, but colder months warrant the most snacking behavior with 34% of consumers saying they snack most during the Winter.

While 60% of consumers claim they snack the same throughout the week, 28% claim they snack more on the weekend.

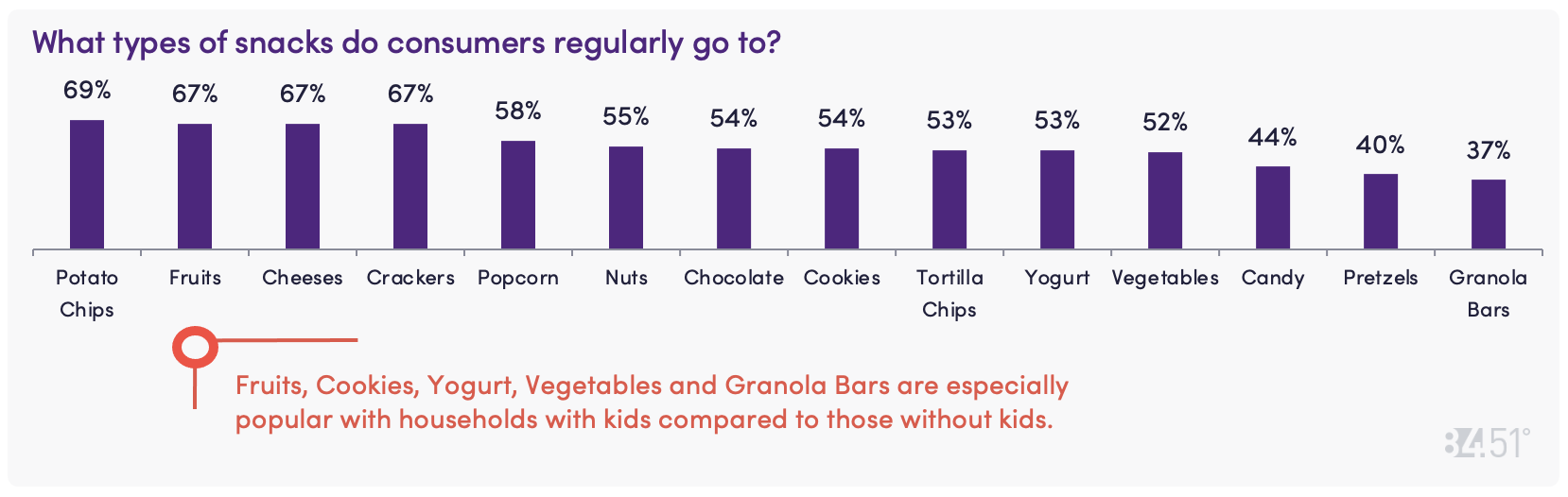

What do consumers snack on?

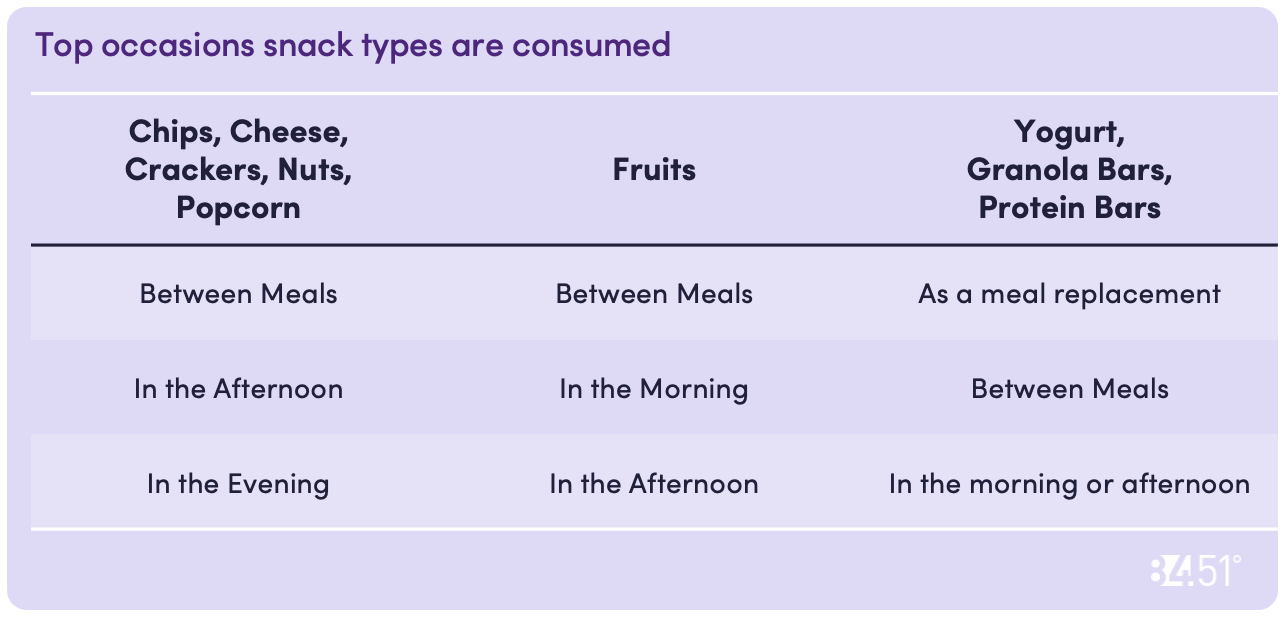

When do consumers reach for different types of snacks?

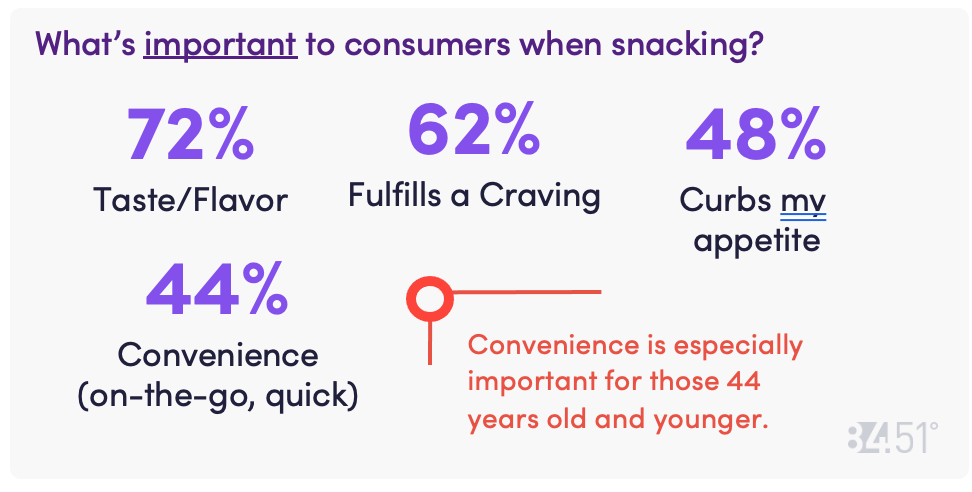

Reasons for snacking

62% of consumers reach for a snack to fulfill a craving, followed by 42% claiming to snack to accompany an activity like reading, watching TV or video games.

60% of consumers say they are snacking the same amount as a year ago. However, those who are under 35 years old are more likely than older consumers to say they are snacking more.

How are consumers buying their snacks?

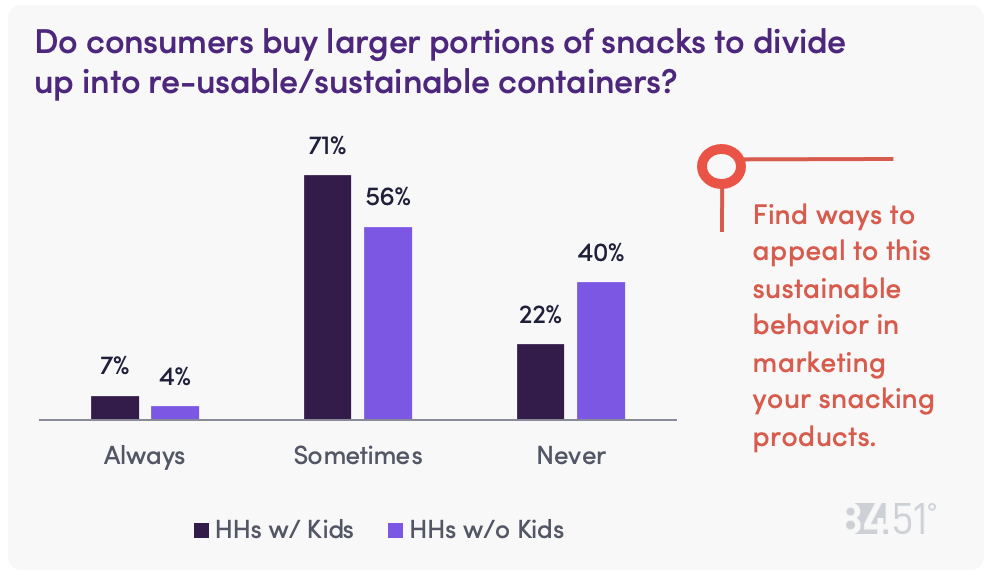

67% of consumers claim to sometimes/always buy larger snack sizes to be able to divide up into other containers later.

This behavior is claimed even more among households with kids.

21% of consumers claim to always stock up on snacks, though the majority (69%) only claim to sometimes do this.

Consumers under 35yrs are most likely to claim that they always stock up on snacks.

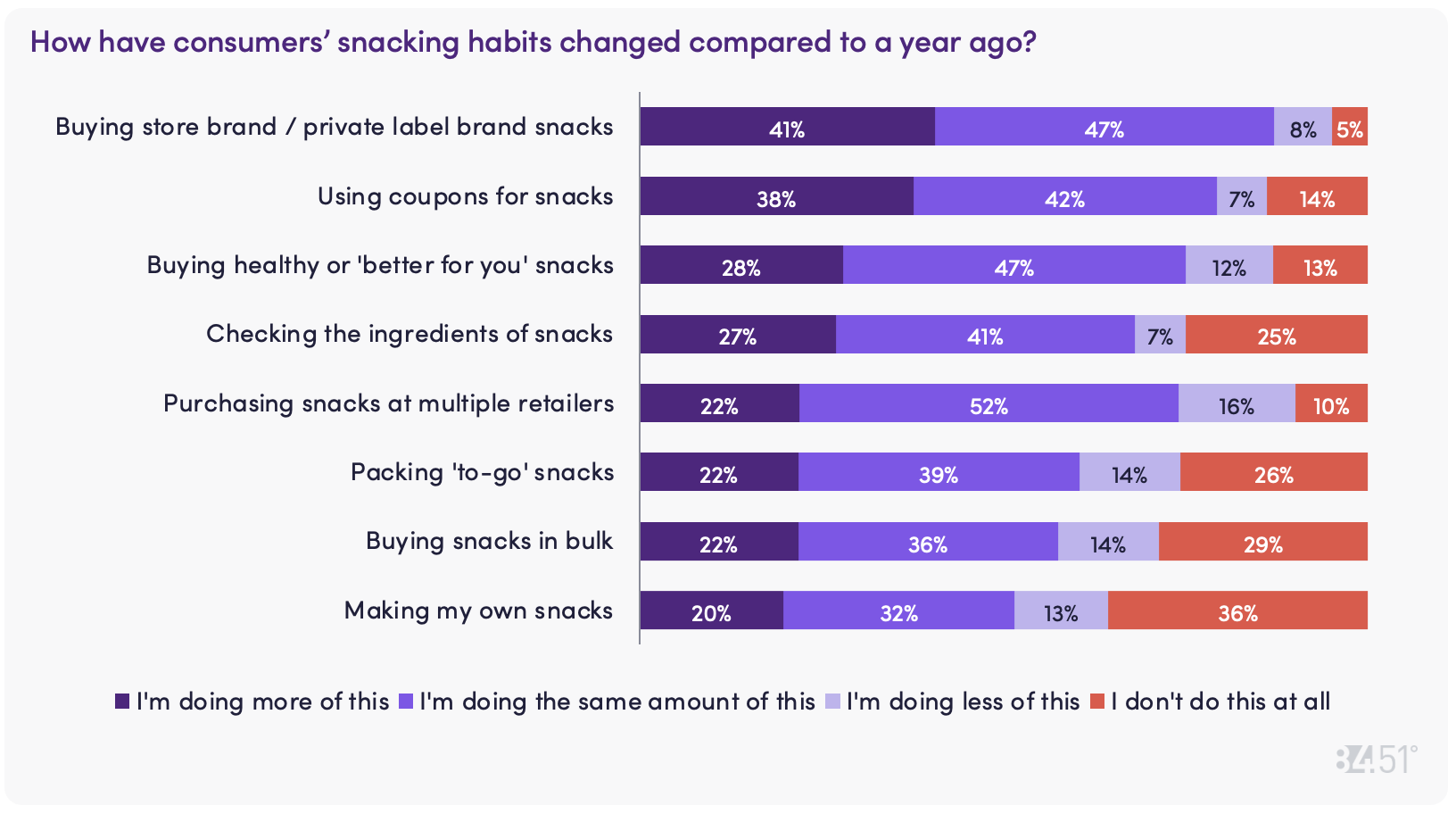

Consumers are looking for ways to save money when buying snacks

Many consumers are trading down to less expensive snack options or searching for coupons to buy their snacks.

Sales, appealing flavors and coupons encourage trial of new snacks

How willing are consumers to try new snacks? (Extremely willing – Top 2 Box)

18-34 year olds: 60%

35-54 year olds: 57%

55-74 year olds: 44%

How do consumers decide what type of new snack to try?

59% The snack item is on sale

58% The flavor/texture of the snack is appealing

51% I have a coupon for the snack item

49% A friend/family member suggested I try it

SOURCE: 84.51° Real Time Insights, May 2023

Visit our knowledge hub

See what you can learn from our latest posts.