Consumer Digest: A Product Innovation Examination

To kick off 2026, we’re focusing on shoppers who lean into the new. This edition of the Consumer Digest reveals that while consumers undoubtedly have their everyday purchase habits, they’re also willing to add new and unexpected items to their baskets if the price is right. Browse the highlights here or download the full report here.

These “innovation shoppers” highlight a fundamental part of retail psychology: novelty is intriguing, and intriguing sells. The only caveat? Awareness matters.

Keep reading to see what the data says about which factors motivate consumers to break from their typical selections.

What does new mean, anyway?

Before diving into the insights, let’s define “new.” When asked what they consider innovation from existing brands, shoppers surveyed said new flavors, seasonal variations, or products with updated features and claims qualify (think high protein or low-fat options).

Now, onto the numbers.

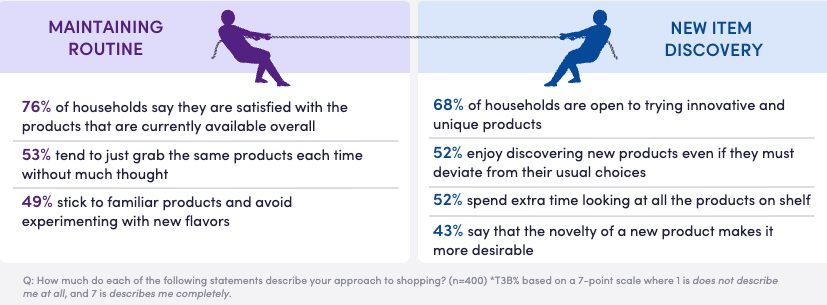

Shoppers are overwhelmingly open-minded

The same tried-and-true grocery brands and items have their place, but at some point, everyone needs a change of pace. That’s why nearly 7 out of 10 (68%) say they’re open to trying innovative and unique products.

The brand takeaway: While introducing new products can feel risky, the data shows shoppers enjoy trying something new. If you’ve built up brand equity, shoppers are more than happy to experiment with an adventurous new flavor or holiday-themed variation of an existing product.

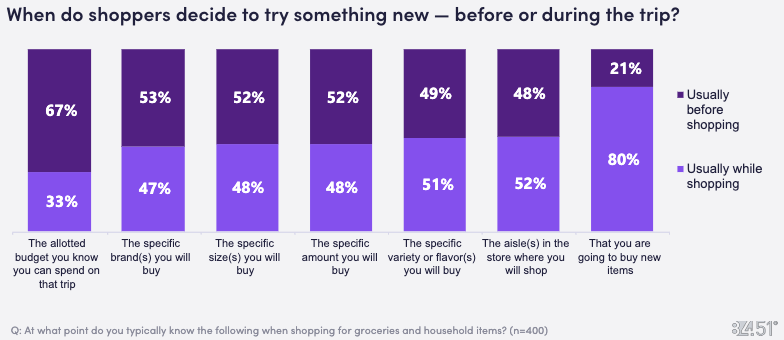

Spontaneous decisions are made in the aisle (but discovery can happen anywhere)

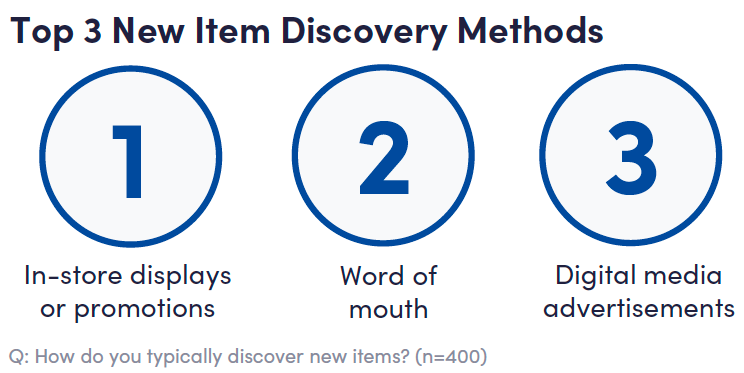

The choice to buy innovative products largely happens at the point of purchase: 80% of respondents said they make the decision to try something new in-store, with nearly an identical number (79%) saying they discover new items via In-Store Displays or Promotions.

The data suggests that even when shoppers have a list heading into the store, they’re still open to new items if something piques their interest. The 41% of shoppers who discovered new items through digital advertisements are already primed when they encounter those products in-store.

The brand takeaway: Building prior awareness on digital channels, and then driving the point home in-store, paves the way for in-the-moment buying decisions.

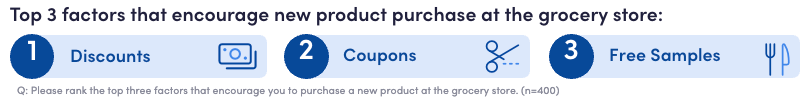

Promos drive experimentation

Discount pricing predictably elevates demand. The interesting insight here is that a modest reduction, as low as 5%, is enough to make 6 out of 10 shoppers want to try a new product.

Strategic promotions across digital and in-store media channels unfailingly generate interest, and that interest often translates to sales.

The brand takeaway: As a tactic to get consumers to try something new, steep discounts are undefeated. However, the data says that you don’t need to go overboard: the difference between a 10% and 20% discount is negligible, indicating that even minor price reductions can be highly effective.

Give shoppers a reason to look twice

Trust your R&D team—product innovation is essential to keeping established brands feeling fresh and current. The survey results should inspire confidence in CPGs looking to drive engagement and interest with their core customers.

Click below to download the 84.51° Consumer Digest and see the latest insights on shoppers’ attitudes toward product innovation.

Visit our knowledge hub

See what you can learn from our latest posts.