Consumer Digest: SNAP Special Edition June 2023

Welcome to the June edition of the Consumer Digest, where we aim to provide relevant informative and actionable insights around consumer trends. This month, we are focusing on the Supplemental Nutrition Assistance Program or SNAP. We’ll take a look at the recent cancelation in emergency allotment (EA) payments and how it’s affecting impacted shoppers. Note that the base used for this study included only those who have used SNAP EBT tender at a Kroger store in the past 26 weeks.

SNAP Overview

The Supplemental Nutrition Assistance Program (known as SNAP in most states) is the cornerstone of the nation’s nutrition assistance safety net. SNAP provides food benefits to low-income households to help supplement their everyday grocery budget.

~42 million people receive monthly SNAP benefits

65% of SNAP participants are households with children

36% are families with members who are older adults or are disabled

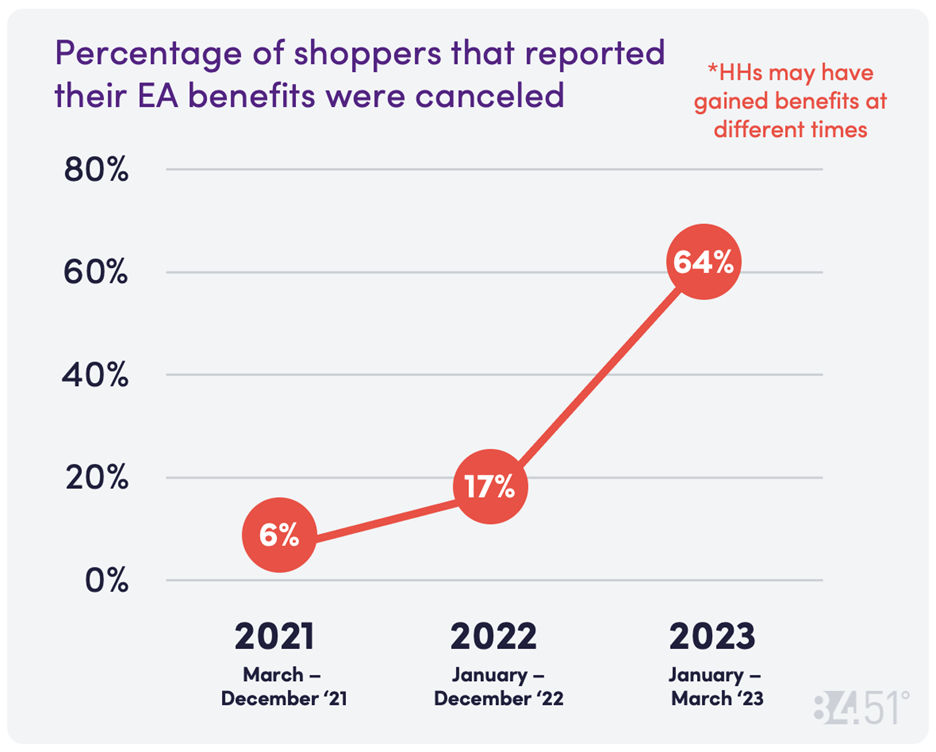

In March of 2020, Congress enacted the SNAP Emergency Allotments (EAs) which were a temporary benefit increase to all SNAP participants. These EA payments were phased out over time and as of March of 2023, these additional payments have all been canceled.

Comparison: SNAP participants vs. general population

Shopper concern over inflation? % of Households Extremely Concerned (T2B)

SNAP: 76%

General Population: 63%

SNAP EA payment cancelation drives financial strain, stress

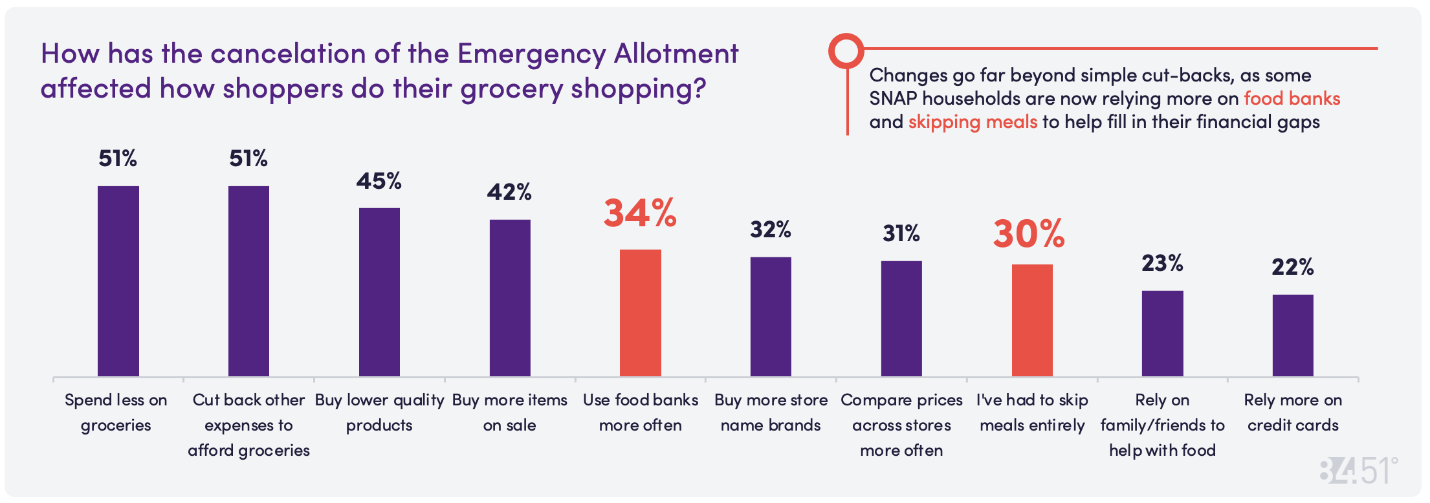

Of households who receive SNAP benefits, 62% reported a significant impact to their overall household budget due to the cancelation of the Emergency Allotment.

Beyond challenges in affording groceries, households are expressing concern over their long-term financial outlook as a result of the EA cancelations.

48% are not able to save any money towards retirement

48% struggle to keep a monthly budget

44% are afraid there will be more future SNAP benefit reductions

30% are behind on payments and cannot keep up

How SNAP shopper experiences differ in grocery vs. dollar channel

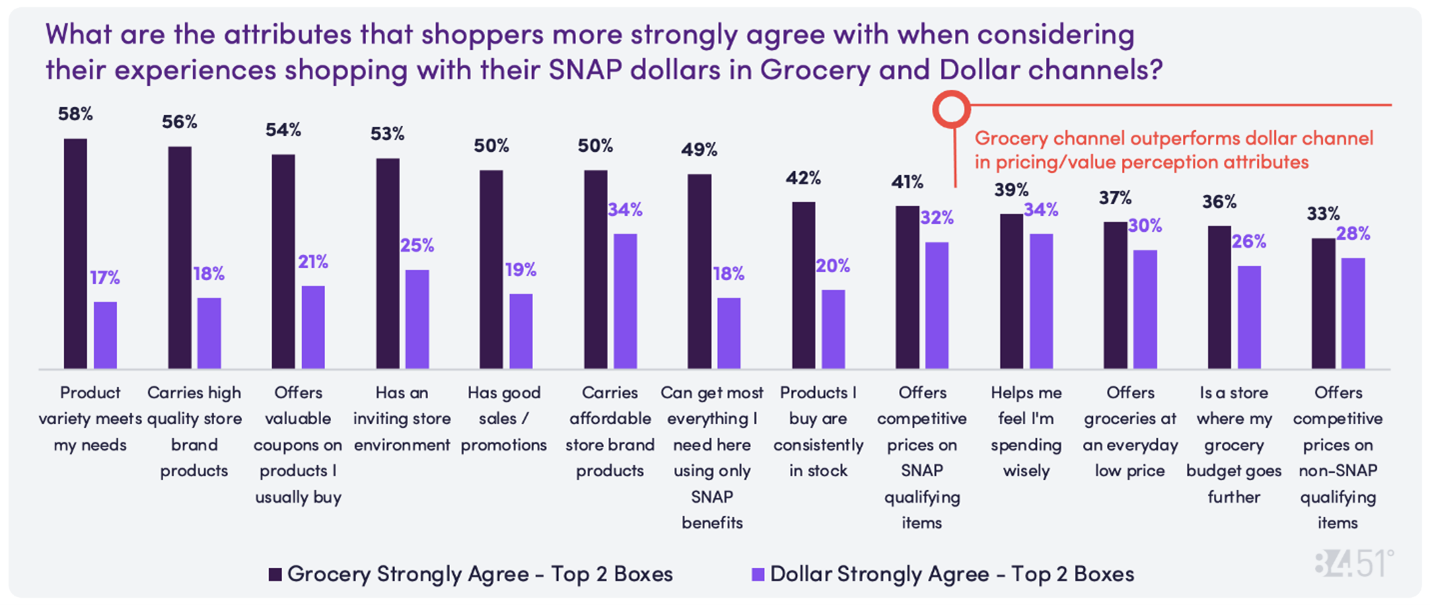

The greatest determining factor for where to shop for groceries when using SNAP benefits is based on which retailer has the lowest prices (43%) followed by weekly sales/promotions (22%).

When EA allotments were cancelled, 37% of shoppers reported shopping more at the Dollar/Value channel, while only 11% reported shopping more at traditional grocery stores. However, a higher percent of shoppers (36% strongly agreed that Grocery Channel is “a store where my grocery budget goes further” compared to Dollar (26%).

Of households using SNAP, 76% say their preferred grocery store does not change depending on the time of month.

Say vs Do: Where SNAP Shoppers are cutting back in-store

SNAP shoppers report cutting back on Snacks/Candy, Deli/Meat/Fish, Fresh Bakery, and Drinks the most. When comparing SNAP household spend declines vs. Total Store declines, the greatest differences do arise in more discretionary categories.

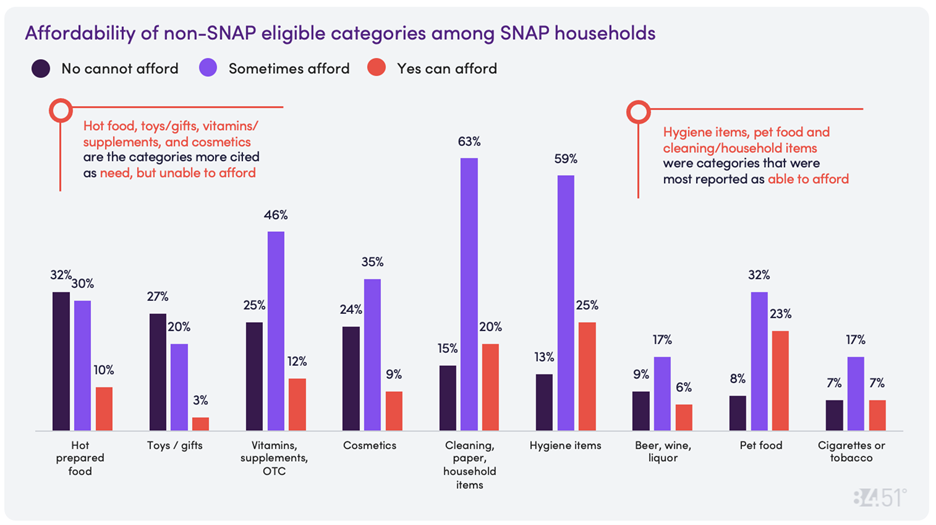

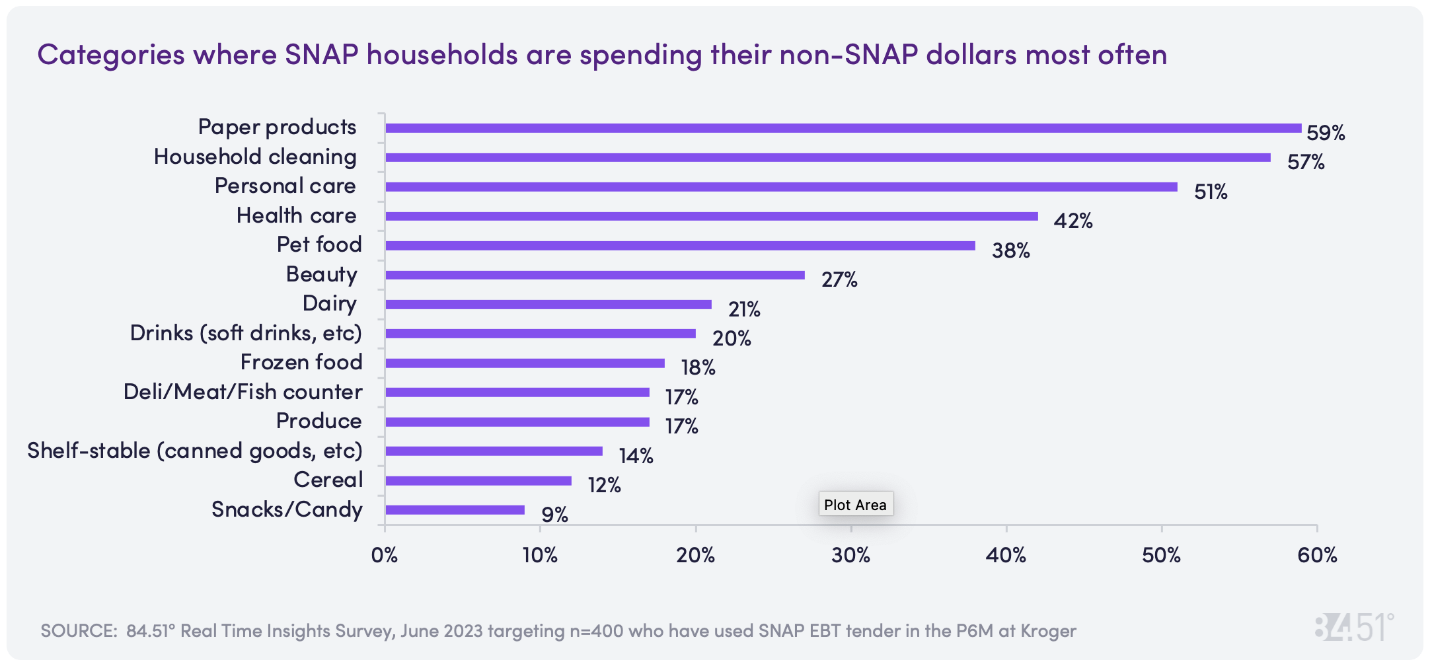

Discretionary spending outside of SNAP dollars

When able to purchase all necessary items covered by SNAP benefits, how do shoppers think about purchasing items not covered by their SNAP benefits?

Categories important to SNAP HHs

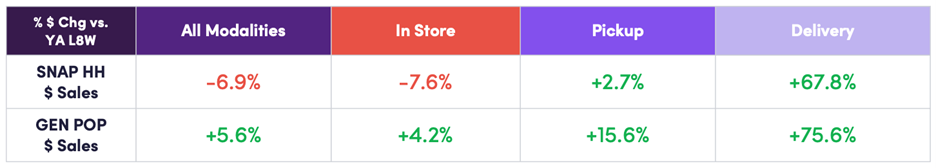

Opportunity exists to drive engagement with SNAP households as their eCommerce interests grow

SNAP households are less developed in Pickup and Delivery, as compared to non-SNAP households. This could be in part as SNAP pickup and delivery results are impacted by the expansion of SNAP online payment capabilities at some Kroger Family of Stores.

60% of SNAP households say that finding SNAP eligible products online is “extremely easy.”

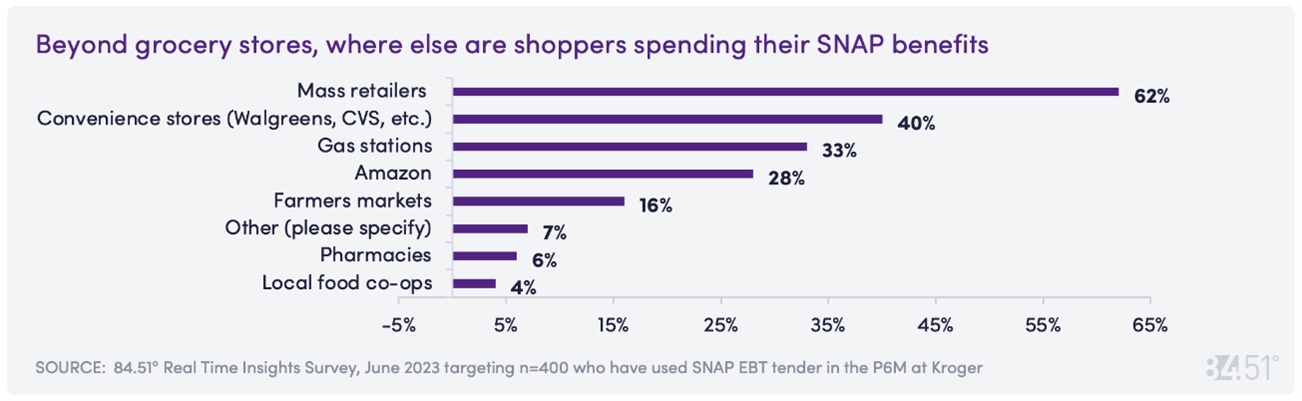

Not just for grocery stores

SNAP benefits can be used at a wide spectrum of retail locations, including farmers markets and online retailers.

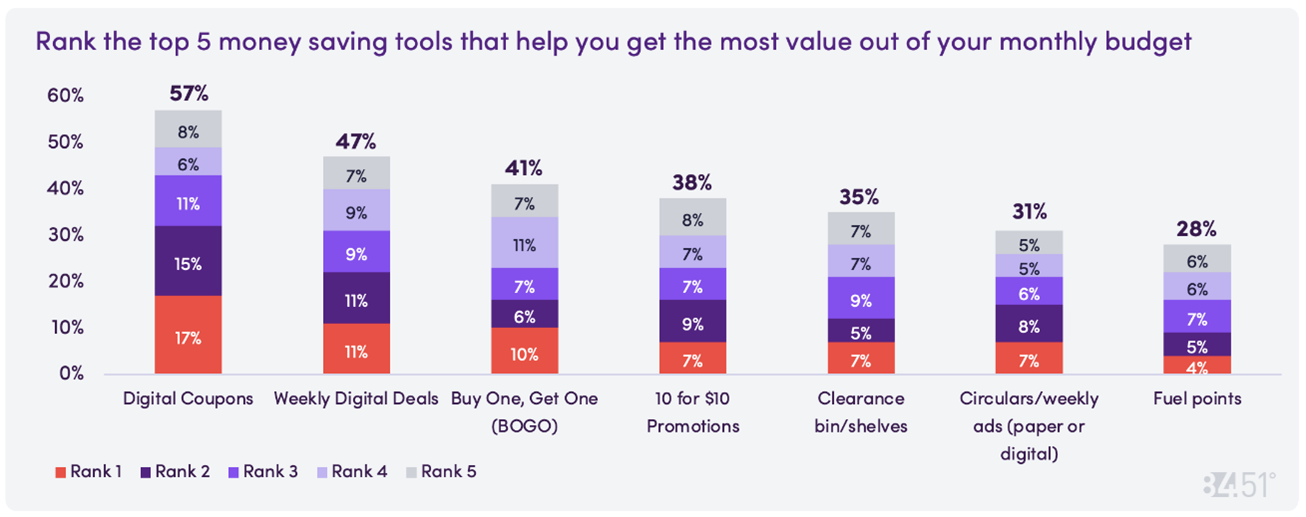

Top promotions valued by SNAP households

Want to dig deeper?

Each month. 84.51°’s Consumer Digest Report delivers relevant and actionable insights around consumer trends directly to your inbox. Now, for an incremental investment, 84.51° invites you to explore these insights the way you want via the 84.51° Consumer Digest Dashboard.

SOURCE: 84.51° Real Time Insights, June 2023

Visit our knowledge hub

See what you can learn from our latest posts.