Consumer Digest: Omnichannel Special Edition - February 2023

Welcome to the February edition of the Consumer Digest, where we aim to provide relevant, informative and actionable insights around consumer trends. This month, we are doing a deep dive into omnichannel shopper behavior. We’ll look at who they are, where they shop, and some of the reasons why they choose to shop the way they do. We’ll also take a look at how they go about building their baskets as well as what’s important to them. Note that the base used for this study included only those who shopped both in-store and online at Kroger over the past 52 weeks.

The omnichannel shopper is someone who buys groceries online and at least some in-store for their grocery and household needs. They are also called hybrid shoppers.

The most loyal ecommerce shoppers still spend 19% of their grocery dollars in-store.

Those with lower ecommerce loyalty spend 78% of their grocery dollars in-store.

The omnichannel shopper is more likely to be the following than the average grocery shopper:

Millennial (168 Index)

Have children (146 Index)

Highly engaged with Natural & Organic (135 Index)

Omnichannel defined by the shopper: What do they expect to be same/similar when shopping the same retailer online & in-store?

67% Same Coupons Available

66% Pricing is the same online & in-store

61% Quality of products is the same

Which best describes how you shop for grocery & household items?

7% All in-store, rarely online

33% Most in-store, online some

19% Online & in-store equally

36% Most online, in-store some

6% All online, rarely in-store

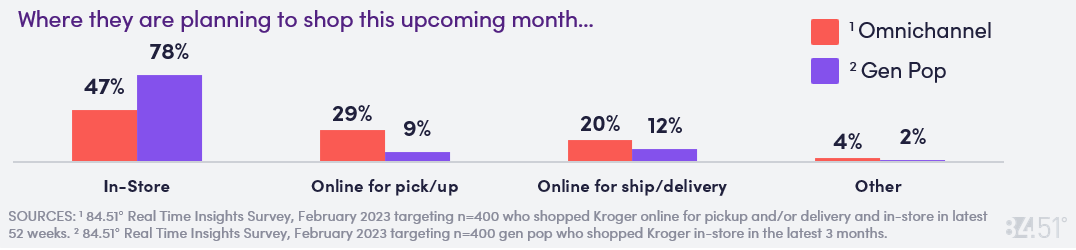

While most shoppers still go in-store for some of their grocery shopping, many are using a mix of retailers for their hybrid shopping.

Omnichannel households making a yearly income of $100k or less are planning to shop online for either pickup or delivery more so than those omnichannel households making more than $100k a year.

Shoppers are choosing to shop in-store most often for the selection.

43% state that selection is one of the key drivers for shopping in-store, while selection is a key driver for only 14% who are ordering online for delivery and only 10% for pickup.

Shoppers are choosing to shop online most often for the convenience.

76% of shoppers who are ordering online for delivery and 73% of shoppers who are ordering online for pickup state that convenience is one of the key drivers for choosing those modalities, while convenience is a key driver for only 31% who are shopping in-store.

Shoppers also choose to shop online to help reduce impulse purchases.

39% are driven to shop online for delivery and 30% are using pickup to help reduce impulse purchases, while only 6% are driven to shop in-store to reduce impulse purchases.

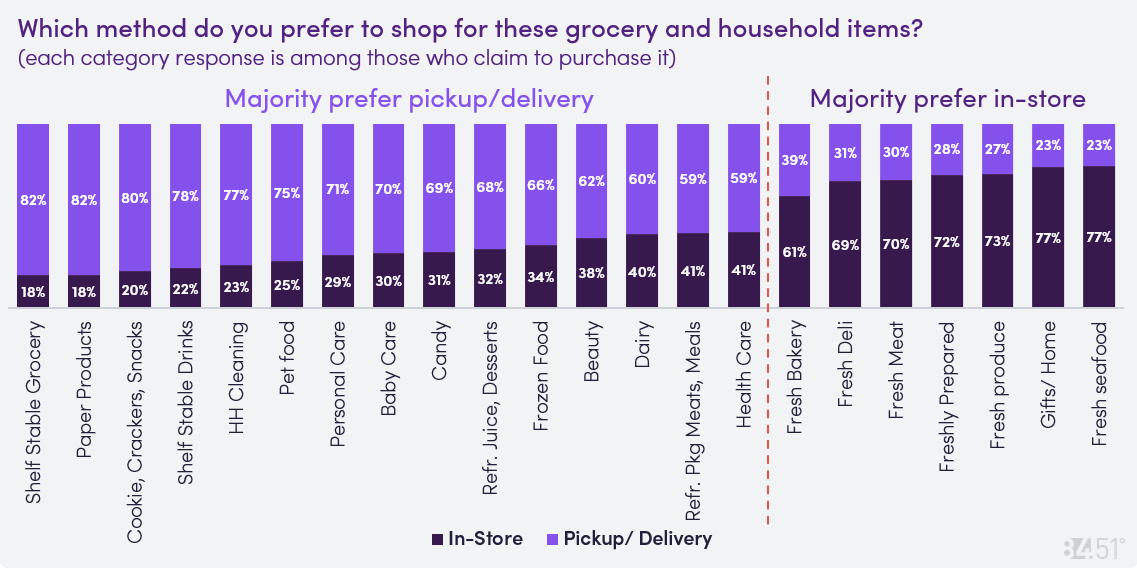

Freshly picked categories (Seafood, Meats, Produce) and Gifts/Home Goods (toys, cards, décor) top the types of categories omnichannel shoppers prefer to shop in-store.

While they claim preferring to buy Produce, Meat and Deli in-store, over 25% of sales for these items among omnichannel shoppers are through pickup/delivery, the same % as shelf stable grocery items.

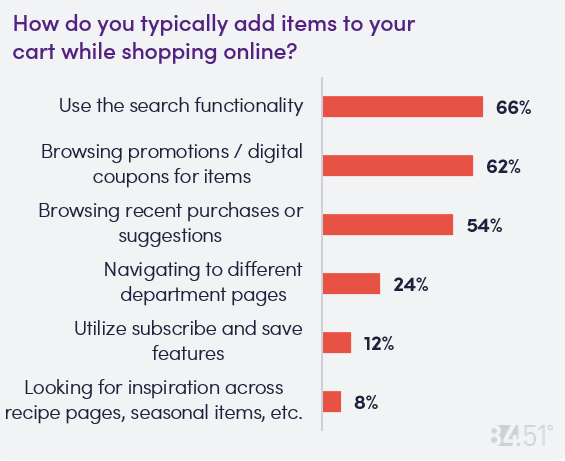

Search, promotions/coupons and recent purchase top the list of how omnichannel shoppers build their baskets.

When asked what features are their favorite, Digital coupons are the clear winner at 73%. This feature is especially loved by very price sensitive omnichannel shoppers.

While a similar % of omnichannel shoppers claim to use search, promos/coupons and recent purchases, search actually accounts for 59% of total “clicks” when shopping online according to our Clickstream Insights.

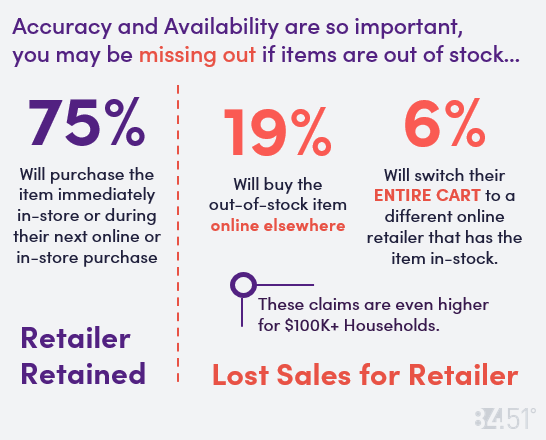

Over 80% of omnichannel shoppers claim that order accuracy and availability are important when shopping online, and 25% will shift their spend if items are out of stock.

Importance when shopping online for grocery & household items – Top 5 (T2B on 7pt scale)

88% Accuracy of my order

81% Availability of items on my list

76% Ability to apply coupons or offers

74% Quality of substitutions

71% Ease of navigating the website/app as I shop

What would drive you to shop more online than you currently do?

61% If the price is cheaper online

50% If there were ore coupons or savings available

47% If there were lower fees for online services

44% If I had fewer issues with substitutions

33% If I was confident someone could select the items I want

How likely are you to try a “new item” when it comes to the following ways you shop? (T2B on 7pt scale)

42% In-Store

15% Online for Delivery

17% Online for Pickup

SOURCES: 84.51° Real Time Insights Survey, February 2023. Base: n=400 who shopped Kroger online (pickup and/or delivery) and in-store in latest 52 weeks

Visit our knowledge hub

See what you can learn from our latest posts.