Consumer Digest: Behavior Insights - Saving vs. Splurging August 2023

Welcome to the August edition of the Consumer Digest, where we aim to provide relevant informative and actionable insights around consumer trends. This month, we are exploring the dichotomy in purchase behavior – saving vs. splurging. We’ll look at shopper’s preferences around national brands and store brands, the top commodities shoppers say they are willing (and not willing) to switch to a store brand and the reasons why. Finally, we’ll wrap up with consumers’ plans for the upcoming football season.

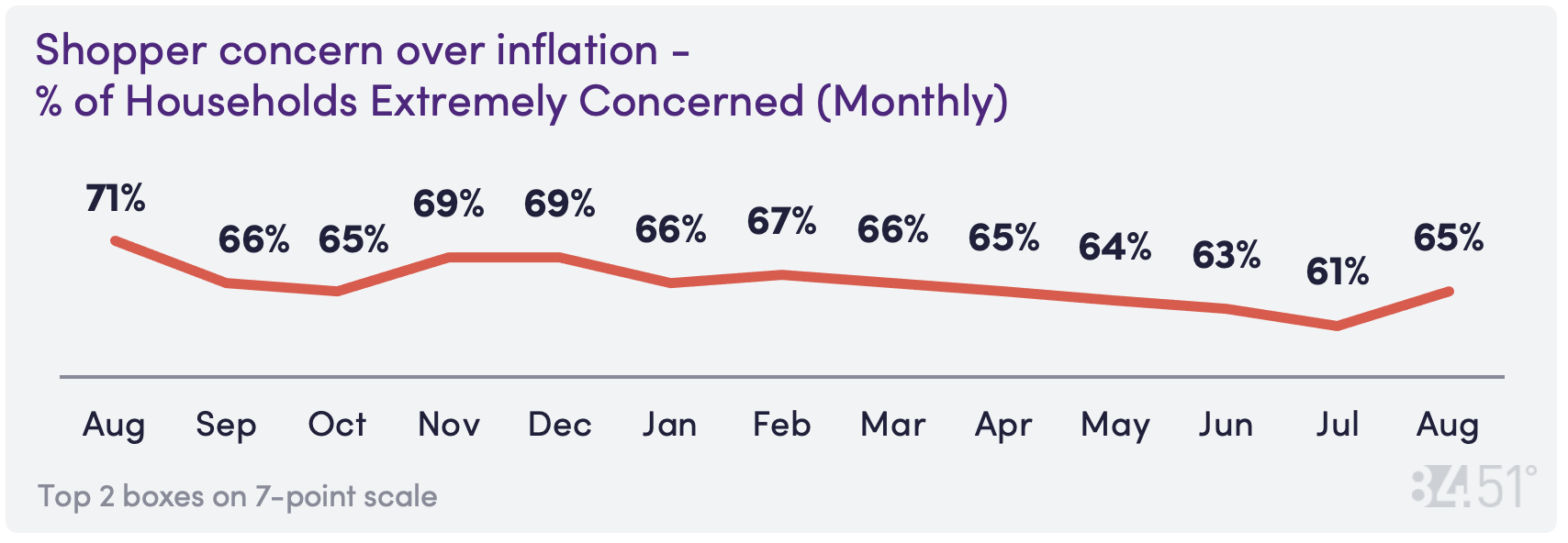

Inflation concerns are bouncing back

Shopper’s concern over inflation is back to Apr’23 levels after a three month-long decline.

Simultaneous splurging + saving in a challenging economy

Recent industry studies reveal a dichotomy in purchase behavior where consumers are looking for savings and pinching pennies due to inflation but still ponying up to spend on items they’re loyal to, passionate about or just generally prefer for a variety of reasons. These items seem to be immune to the trade down trend that’s been taking place as CPI has skyrocketed over the past two years.

Using the 84.51° Stratum and Real Time Insights platforms, we set out to learn more about this phenomenon - what is and is not immune to the trade down trend.

National vs. store brand preferences

8% Prefer National Brand

29% Prefer National Brands but open to Store Brands

17% No specific Brand preferences

16% Prefer Store Brands but open to National Brands

31% Prefer Store Brand

Top commodities shoppers are willing to switch to store brands

Frozen +3.8%

Shelf Stable +1.7%

Household Cleaning -2.6%

Healthcare (OTC) +2.7%

Top reasons why: willing to switch to store brands

Quality is just as good

Store Brands offer variety/selection that meets my needs

Store Brands offer product size(s) that meets my needs

Top commodities shoppers are not willing to switch to store brands

Pet +2.7%

Personal Care +0.04%

Beauty +7.4%

Drinks +2.1%

Top reasons why: not willing to switch to store brand

Quality is not as good

I always buy some national brands I like

Store Brands do not offer the variety or selection that meets my needs

Retail therapy & permissible pleasures

The top 10 items shoppers purchase with the intent to treat themselves...

Candy

Baked Goods and Treats

Snacks

Ice Cream

Self-Care Products

Beverages

Hair Care Products

Name Brand Products

Cheese

Makeup

And what exactly motivates the “treating”?

Taste

Price/Sale

Cravings

Reward/Treat

Quality/Experience

Moods/Emotions

Good Deals

Packaging/Product

Nostalgia/Preference

Money/Budget

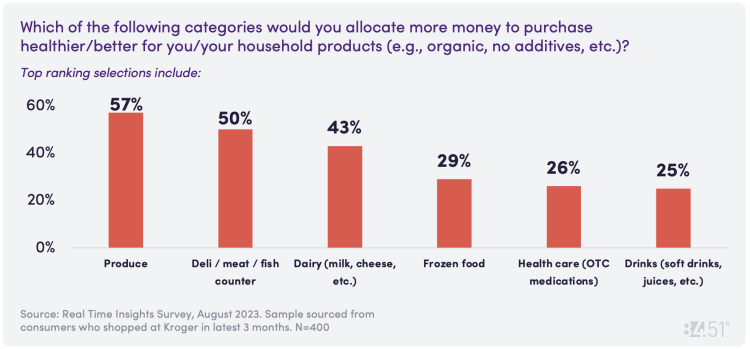

Spending on “better for you” products

Thinking of budgeting when shopping for groceries or household items, we asked:

Motivations pyramid

To dig a little deeper and get an understanding on the “why” related to budgeting for healthier/better for you/your household products (e.g., organic, no additives, etc.), we asked: What motivates you to allocate more money for purchasing those products?

Highest ranking responses submitted from open-ended questions in order:

Health

Quality

Better for the Body

Saving Money

Motivation

Necessity

Family

Organic

Healthier Options

Cleaner & Better for the Environment

Are you ready for some football?!?

With football season upon us, we asked consumers if they are planning to watch or attend any football games (e.g., pro, college, high school). Numbers exceed 100% due to multi-select responses.

85% Plan to watch games at home, host a party at home or watch at someone else’s home.

25% Plan to attend games in person (in or out of town).

21% Plan to go out to watch the games.

What kinds of pre-game activities consumers plan on attending during the football season, if any. Numbers exceed 100% due to multi-select responses.

43% Gatherings at my house

38% Gatherings at someone else’s house

28% Plan to gather at an establishment(e.g., sports bar, local pub, restaurant)

19% Plan to gather near/at the stadium (e.g., tailgating in the lot)

Top items shoppers are planning to purchase in a traditional grocery store for upcoming pre-game activities:

Chips/Pretzels

Soft Drinks

Dips/Salsas

Alcoholic Beverages

Hot Dogs/Brats/Sausages

Paper Products/Plates/Napkins

Cheese Snacks

Condiments

Fresh Meat

Prepared Meat (rotisserie chicken)

Want to dig deeper?

Each month. 84.51°’s Consumer Digest Report delivers relevant and actionable insights around consumer trends directly to your inbox. Now, for an incremental investment, 84.51° invites you to explore these insights the way you want via the 84.51° Consumer Digest Dashboard.

SOURCE: 84.51° Real Time Insights, August 2023

Visit our knowledge hub

See what you can learn from our latest posts.